As we all know, having an accounting system is a vital piece of any successful business. An accounting system provides an automated and easy way to track how much money is being made vs. how much money is being spent.

Creating proper accounts in an accounting system to track business Assets, Liabilities, Equity, Income, Cost of Goods Sold, and Expenses will allow your construction client to see an overall picture of their company’s worth or value from a financial standpoint – not only for themselves, but also when they apply for a loan, or have to be bonded.

A construction company, like any other company, has numerous responsibilities – to their employees, customers, vendors, subcontractors, investors, and even the government.

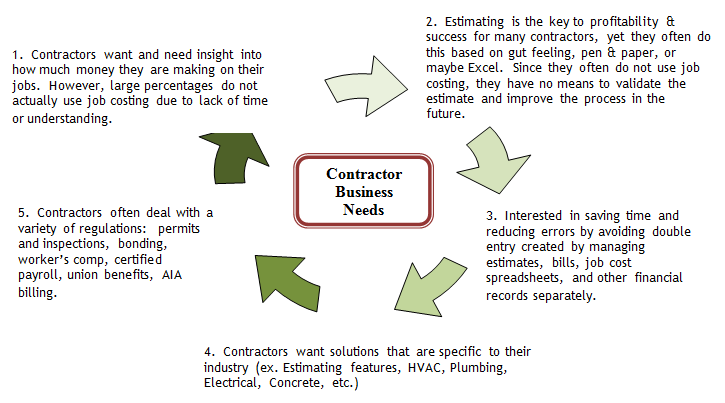

Contractor Business Needs:

The construction industry has some very specific accounting requirements. In addition to Payroll, Accounts Receivable, and Accounts Payable functions, they need to be able to have systems to handle Estimating, Job Costing, Overhead, Billing and/or Invoicing, Project Management, Scheduling, and Customer Management – just to name a few.

No two contractors will have the EXACT same need for functionality OR use the exact same cost coding system for billing. Even if two construction companies are similar (for example, two plumbing contractors), a bookkeeping system may need to be modified to meet the needs of each business. A bookkeeping system should be designed to meet the needs of each business, keeping in mind that it should not be overly complex and should take into consideration:

- the types of transactions the business enters into and how information about those transactions can be captured, and

- the type of financial information the business needs to efficiently manages its operations

So, do not let anyone tell you that every contractor uses a specific Chart of Accounts or Cost Coding system.

A typical construction specific accounting program (which carry a big price tag) includes:

- Accounts Payable

- Job Cost Management

- Accounts Receivable

- Payroll – including Union Payroll, Certified Payroll, Union Reports

- Detailed Job Budgets

- Flexible Billing modules – including Time & Materials billings, AIA billings, Over & Under Billings

- General Ledger

- Subcontract status

- Custom job reports

- Purchase Orders

- Inventory

- Equipment Tracking

- Work in Progress

- Retainage Receivable

- Retainage Payble

- Construction Loans

There are many software packages available for the construction industry – ranging from $5,000.00 to $50,000.00 in price with expensive annual updates, that do not include support. Because of this, especially in this tight economy, more and more contractors are switching to QuickBooks Pro, Premier, or Enterprise to fulfill their bookkeeping and accounting needs.

QuickBooks, while not specifically developed for the construction industry is:

- extremely user-frindly

- can provide a very strong accounting structure “backbone”

- can be operatoed by personnel who have little computer knowledge (bookkeeping and accounting knowledge, however, is important – you need to know your “debits from your credits”)

- with the use of reasonably-priced QuickBooks integrated applications to provide some of the higher level functionality

QuickBooks, when used in conjunction with 3rd party integrated applications, is a viable and cost-effective choice for contractors.

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What’s So Contractors Using QuickBooks Have Special Bookkeeping Needs | Sunburst Software Solu… […]

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What’s So Contractors Using QuickBooks Have Special Bookkeeping Needs | Sunburst Software Solu… […]

[…] What's So Contractors Using QuickBooks Have Special Bookkeeping … […]

[…] What’s So Contractors Using QuickBooks Have Special Bookkeeping Needs | Sunburst Software Solu… […]