QuickBooks provides you with a powerful, and time saving tool within your items list, which is often under utilized and often misunderstood — the QuickBooks Group Item.

5 Reasons To Use QuickBooks Group Items:

- Creating and using Group Items is useful for quickly entering a group of individual items that you have already set up as single items in your Item List.

- Group Items are versatile – you can choose to print – or – not to print the items within the group, meaning you can track more detail than your customer needs to see.

- Group Items ensure that you don’t “leave something out” – which means lost dollars on your part.

- Group Items speed up the creation of Estimates and Invoices – imagine being able to pull in 19 items with a single click of a mouse.

- Group Items allow you to bridge the difference in units of measure used to buy and sell products or materials.

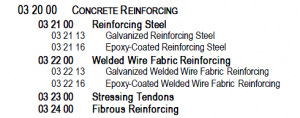

The following example deals with the CSI MasterFormat Cost Code section 03.20.00 for Concrete Reinforcing.

How to create a Group Item

In the QuickBooks Item list, you’ll want to have the individual items set up (03.21.00 through 03.24.00) as double-sided items.

Once these items are in place.

From the Item List, click the Item button at the bottom of the list window -> select New. From the New Item window choose Group from the Type drop down menu. In the Group Name/Number type in 02.20.00 Concrete Reinforcing, in the Item column select each of the individual components on the Concrete Reinforcing section. I’ve even added an Subtotal and Overhead & Profit item to the group. My group now contains a total of 10 line items.

IF you want your customer to see all 10 lines within the group, click into and place a check in the “Print items in group” option. IF you do not want your customer to see all 10 line items, leave this option unchecked and they will see ONLY 03.20.00 Concrete Reinforcing, while YOU still see all the detail.

How to Use the Group Item After It’s Created

Open an Estimate or Invoice form, click into the Item Column, find the Group Item and enter you cost amounts (enter costs ONLY if you are using an Overhead & Profit item within the group). As you enter the cost associated with each line item, QuickBooks calculates and updates the subtotal, overhead & profit (if the item is setup as a percentage), sales tax (if applicable), and Estimate total.

When you use the Item list for job costing (on vendor bills, checks, etc.) you would still job cost against the individual items in the item list.

Tomorrow, in Part 2, find out how to use Group Items to bridge differences in units of measure.

Hello Edward

I apologize for the delay in responding to you, I was out of town last week attending a QuickBooks conference in Las Vegas.

I have almost completed moving the CSI Cost codes into a downloadable IIF file, suitable for importing into QuickBooks. My main concern (and one of the reasons that I’ve been dragging my feet over it) is the list limitations in QB Pro & Premier. Do you want/need all the divisions or only some of them? Why don’t you contact me privately using the Contact Us form to discuss this further.

I am a construction contractor and I am using Quickbooks Premier 2013 for Contractors. I do need to use the CSI codes but were can I go to download into my quickbooks to save all the typing time? Thank you so much for the info you post on your Blog.

Group Items can contain any QuickBooks Item types EXCEPT for another group item.

If you rely heavily on Inventory Items, you might want to experiment with an Inventory Assembly Item – it works the same way as a “normal” group item.

Great article, thanks!

I have a few technical questions:

Do the items entered in the Group have to be Inventory Items or Non Inventory Items? Does it matter? I want to do a profitable analysis when all job costs have been entered.

I want to use the Group method for entering Estimates (calculated from Excel ws). How do I enter the actual inventory items against this Estimate? i.e. in the “body” of the Group Items, or, below the sub total of the Group Estimate Total?

[…] and set up items that correspond to that master list of of the things your company does, creating Group Items or Inventory Assemblies if […]