The “List” is another basic QuickBooks feature. You will fill out most QuickBooks forms by selecting entries from a list. Lists save you time and help you enter your information consistently and correctly.

You will find yourself always using these standard lists:

- Chart of Accounts

- Item (Cost Code)

- Fixed Asset

- Price Level

- Billing Rate Level

- Sales Tax Code

- Payroll Item

- Class

- Workers Comp Code

- Other Names

When you select any of these Lists, they display various information, arranged in columns. Did you know that these columns can be customized to display additional information that would be valuable to you and your company?

A good example of customizing information that is displayed in the Chart of Accounts List would be to automatically know, just by looking at the Chart of Accounts, which accounts had been flagged as being 1099 accounts – without having to go into the 1099 Preference and determining which accounts had been selected.

To display a 1099 flag in your Chart of Accounts, you would:

- From the Lists menu

- Choose Chart of Accounts

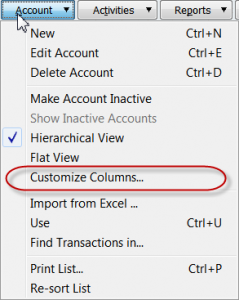

- Click the Account button at the bottom of the window

- Choose Customize Columns

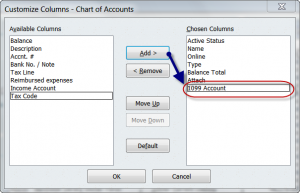

- This displays a Customize Columns – Chart of Accounts window which displays a list of Available columns on the left and Chosen columns on the right. Click on the 1099 Account option to select it, then click the Add button.

- The 1099 Account option is now displayed in the Chosen Columns on the right. Click Ok to save your changes.

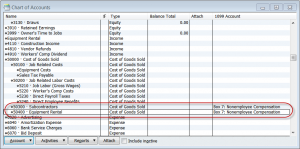

- Now, when you display your Chart of Accounts List, any accounts that have been selected for 1099 reporting will be flagged and display the type of 1099 required.

Customizing the columns displayed in the Chart of Accounts listing to display 1099 flag provides a productivity boost all year long – not just at year end.

Go ahead and experiment with the information displayed in various lists by selecting available columns on the left and adding them to chosen columns on the right.

Simple customization such as this will help you get more done in less time – because you don’t have to constantly search for information.

Thanks Laura. Tracking 1099’s is such a pain!

This is a great idea!!

I use the customize columns to add that column to the vendor list, but never thought to use it on the Chart of accounts.

Thanks for sharing!!

Laura D