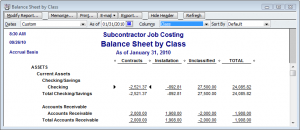

The Balance Sheet by Class Report was first introduced with QuickBooks 2011, however, it is also available in QuickBooks 2012, 2013, and 2014; has specific requirements for handling many or our normal day-to-day transactions; it gives users the option of selecting “Classes” (fund, location, profit center, or other category) as their column/class grouping.

Over the last several days, I’ve been discussing and sharing some information about how we all will need to change our data entry procedures in order to utilize the Balance Sheet by Class Report available in QuickBooks 2011.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 1, we touched briefly on the fact that transactions will have to be entered in a very specific manner and there are many data entry transactions that are not supported by the Balance Sheet by Class Report

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 2, we discussed how accounting professionals and end users would need to change their procedures when creating journal entries so that they were balanced

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 3, we discussed how users and accounting professionals would no longer be able to assign multiple classes to a single paycheck.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 4, we discussed how you would need to classify Payroll Liability Payments in order for them to be appropriately recognized on the final report.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 5, we discussed how you need to classify Sales Tax Liability Payments using a Journal Entry AFTER you actually make the payment.

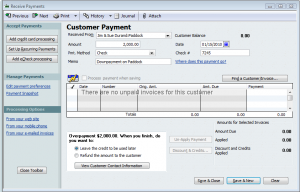

In this article, we’ll discuss how you must handle Customer Prepayment when you record them using the Receive Payments option.

As a business owner who frequently receives customer prepayments on upcoming work, if you receive the prepayment from the customer using the Receive Payments window and selecting the option to Leave the credit to be used later, the prepayment amount will appear in the report in the “Unclassified” column.

The prepayment displays in the Unclassified column on the Balance Sheet by Class because you cannot enter a class in the Receive Payments window, and QuickBooks doesn’t have a prior transaction in the work flow to reference class information, because there isn’t any prior transactions in the work flow – such as an invoice, which could be used to obtain the class.

Unlike many of the other special requirements we’ve discussed, there is some good news about Receiving Customer Prepayments, and that is — this problem corrects itself; when you create and apply an invoice to the payment at a later date; because the invoice will have a class assigned to it.

Because this problem is self-correcting in the long run, many business owners may decide to not bother to correct the prepayments.

|

Request our FREE 142-page “What’s New in QuickBooks 2011? eBook, by completing a simple request form.

This eBook will provide you with with all the information I’ve posted here in our blog, plus MORE! Once you’ve completed our simple request form, you’ll have instant access to this 142-page .pdf eBook, designed to be duplex printed and put in a binder for future reference. |

[…] Archives by Month Select Month March 2013 (1) February 2013 (1) January 2013 (1) November 2012 (2) October 2012 (2) September 2012 (4) August 2012 (6) July 2012 (7) June 2012 (10) May 2012 (14) April 2012 (10) March 2012 (14) February 2012 (10) January 2012 (19) December 2011 (4) November 2011 (4) October 2011 (8) September 2011 (14) August 2011 (11) July 2011 (12) June 2011 (21) May 2011 (16) April 2011 (11) March 2011 (21) February 2011 (20) January 2011 (13) December 2010 (11) November 2010 (17) October 2010 (10) September 2010 (17) August 2010 (10) July 2010 (17) June 2010 (17) May 2010 (14) April 2010 (21) January 2010 (3) October 2009 (5) September 2009 (9) August 2009 (3) July 2009 (2) June 2009 (2) May 2009 (2) April 2009 (4) March 2009 (8) February 2009 (9) January 2009 (8) December 2008 (13) QuickBooks 2011 – New Balance Sheet by Class Report – Part 8 » « QuickBooks 2011 – New Balance Sheet by Class Report – Part 6 […]

[…] Part 6, we discussed the effect of handling customer prepayments when using the Receive Payments window. […]

Hi Penny

Thanks for stopping by and taking the time to leave a comment 🙂

I’m glad to hear that this series of articles have been helpful and even though I have been exploring this report, I still haven’t really figured out how it will impact the contractors that I deal with! I have several contractors who I think this report would really help out – the problem is that getting everything to balance is just so complex.

Thank you for this entire series of articles. I haven’t yet explored the implications of the Balance Sheet by Class. It’s a great feature, but I haven’t quite figured out how it applies to my current clients and this really helps.