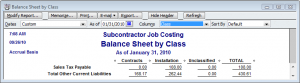

The Balance Sheet by Class Report was first introduced with QuickBooks 2011, however, it is also available in QuickBooks 2012, 2013, and 2014; has specific requirements for handling many or our normal day-to-day transactions. it gives users the option of selecting “Classes” (fund, location, profit center, or other category) as their column/class grouping.

Over the last several days, I’ve been discussing and sharing some information about how we all will need to change our data entry procedures in order to utilize the New Balance Sheet by Class Report available in QuickBooks 2011.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 1, we touched briefly on the fact that transactions will have to be entered in a very specific manner and there are many data entry transactions that are not supported by the Balance Sheet by Class Report

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 2, we discussed how accounting professionals and end users would need to change their procedures when creating journal entries so that they were balanced

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 3, we discussed how users and accounting professionals would no longer be able to assign multiple classes to a single paycheck.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 4, we discussed how you would need to classify Payroll Liability Payments in order for them to be appropriately recognized on the final report.

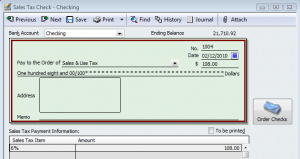

In this article, we’ll discuss how Sales Tax Liability Payments must be handled.

When you create an invoice, the sales tax that you owe will be accurately displayed on the Balance Sheet by Class report under the appropriate class heading.

However, when you create the Sales Tax Liability check, the amount will appear in the Unclassified column of the Balance Sheet by Class Report in both cash and accrual based reports.

The reason that your Sales Tax liability payment is not accurately allocated is because there is not a Class column available in the Sales Tax check form.

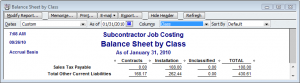

The resolution in the QuickBooks Help file provides pretty clear instructions on how you, as the QuickBooks user or accounting professional, can manually allocate classes to the payment AFTER you create the Liability Check, through the use of a Journal Entry. However, you must follow the instructions carefully in order for your Balance Sheet by Class report to be accurate.

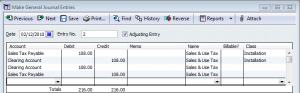

In order to resolve this problem, you will need to create a journal entry to move the sales tax payment amount from unclassified to the correct class. In order to accomplish this, you’ll need to:

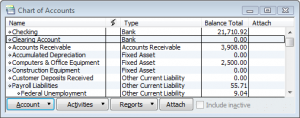

Create a special “Clearing” Bank account in your Chart of Accounts, if you currently do not have one.

Run a Balance Sheet by Class report as of the date that you will be paying the Sales Tax through, (1/31/2010) to determine the amount of Sales Tax that you owe for each class ($108.00 liability for the Installation class).

Make a journal entry to move the payment from the unclassified column to the appropriate class, using the Clearing Account.

The Clearing Account should ALWAYS have a zero balance.

While this work around will provide an accurate Balance Sheet by Class Report, procedures will need to be changed, documented, and followed carefully. Business owners will need to inform the accounting professionals that they work with of these new procedures.

How will this procedure impact you, as a business owner or accounting professional?

|

Request our FREE 142-page “What’s New in QuickBooks 2011? eBook, by completing a simple request form.

This eBook will provide you with with all the information I’ve posted here in our blog, plus MORE! Once you’ve completed our simple request form, you’ll have instant access to this 142-page .pdf eBook, designed to be duplex printed and put in a binder for future reference. |

[…] 2011 – New Balance Sheet by Class Report – Part 5, we discussed how you need to classify Sales Tax Liability Payments using a Journal Entry AFTER you […]