A QuickBooks payroll tip for calculating Workers Compensation when it is based on hours worked.

Workers Compensation Insurance is usually calculated as a rate which is applied to gross wages; and that’s how the built-in QuickBooks Worker’s Compensation feature calculates it. Last week, on the Intuit Community Forum, someone asked how you would set QuickBooks up to track Workers Compensation when it was a rate based on hours worked.

I gave a brief overview on the forum, but thought that it deserved a more detailed “how to” here on our blog.

Before you begin, you’ll need at least three accounts in your Chart of Accounts to track your Liability and Expenses:

- one to track the accruing Worker’s Compensation Liability {an Other Current Liability Account}

- one to track job or field related Worker’s Comp Expenses {a Cost of Good Sold or Direct Labor Costs}

- one to track administrative or overhead Worker’s Comp Expenses {an Expense account}

Next you’ll want to get your Worker’s Compensation rate sheet and using the rate sheet we’ll being adding QuickBooks Company Contribution Payroll items for each different classification code/experience rate.

- From the Lists menu -> choose Payroll Item List

- click the Payroll Item button at the bottom left

- choose New

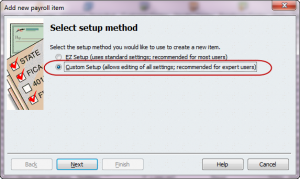

- select the Custom Setup option

- click the Next button

- select the Company Contribution option

- click the Next button

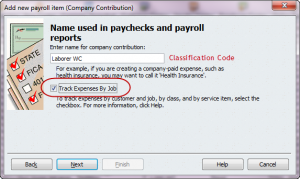

- type in the classification code/experience rate name

- check the option to Track expenses by job {this selection is crucial for job costing}

- click the Next button

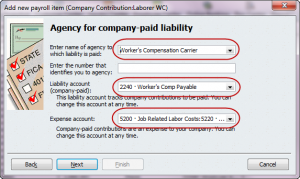

- select your Worker’s Compensation Carrier

- select the Other Current Liability Account for tracking your accrued liability

- select your Cost of Goods Sold or Expense account

- click the Next button

- in the Tax tracking type window, select None, click the Next button

- on the Taxes window, none of the tax items should be checked, click the Next button

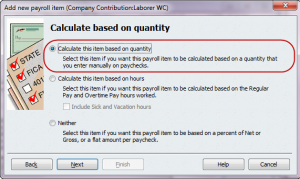

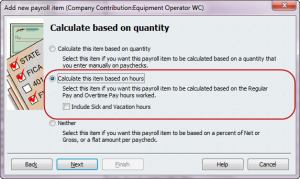

- on the Calculate based on Quantity window you can choose two different methods of calculation:

- Calculate this item based on quantity – use this option if your employees perform work under more than one classification/experience rate during the week. You will have full control of the number of hours that count toward each experience rate.

- Calculate this item based on hours – use this option if each of your employees perform work under only a single classification or experience rate during the week. QuickBooks will automatically calculate the rate based on the total number of Straight and Overtime hours worked.

Using the Calculate this item based on quantity option:

- click the Next button

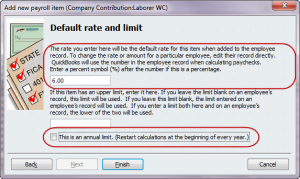

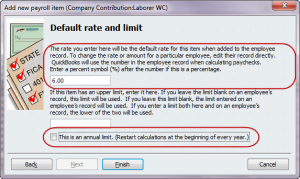

- on the Default rate and limit window – in the first box, enter the experience rate for this classification, leave the 2nd field empty, and make sure that you UNCHECK the “This is an annual limit” option

- click the Finish button.

Add this company contribution payroll item to each applicable employee’s record.

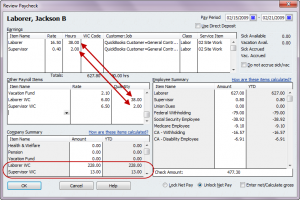

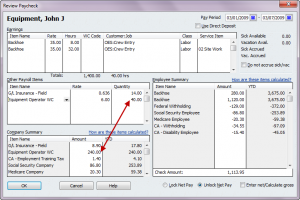

When using this method, when you are creating the employee’s paycheck you will manually enter the number of hours that the employee worked under each experience rate in the Quantity column, once you enter the Quantity {number of hours} for each experience rate QuickBooks will perform the calculation and display the applicable amount in the Company Contribution section of the paycheck.

Using the Calculate this item based on hours option:

- click the Next button

- on the Default rate and limit window – in the first box, enter the experience rate for this classification, leave the 2nd field empty, and make sure that you UNCHECK the “This is an annual limit” option

- click the Finish button.

Add this company contribution payroll item to each applicable employee’s record.

When using this method, when you are creating the employee’s paycheck QuickBooks will automatically make the calculations for you by displaying the total number of hours the employee worked against the experience rate in the Quantity column and display the applicable amount in the Company Contribution section of the paycheck.

When you pay your Worker’s comp do so through the Pay Liabilities option.

We hope that you’ve found this article to be helpful, including Worker’s Compensation costs – regardless of how they are based – is an important part of your job costing.

Hi Joyce, I apologize for the delay – I’ve had trouble accessing the back end of my site so I could get in here an respond to comments! Technology is sometimes very frustrating. The first report that comes to mind is a normal payroll summary report for the quarter – modified to show hours. From there you can just display the totals. I think that would give you the information you are looking for.

Brando, I think you’ve somehow misunderstood. First of all I used a made up rate, secondly this calculation is not based on gross wages but based on the number of hours worked.

According to your example: The worker had 38 hrs at $16.6 per hr for a total of $627. So, you have $228 in workers comp and according to my calculation that is almost 40% in workers comp…not 6%??

Hi Nancy. Thank you so much for the great article. We are in construction so we have multiple catagories for our State Industrial accounts, that I am just now setting up. How do I get a report on hours for each category and hours so that I can pay this liablilty quarterly?

Erin

You’ve brought up an excellent point – there isn’t any way that you can pull the worker’s comp costs onto an invoice. I haven’t attempted this in quite some time because I did get so frustrated with it. I’ll have to give it a shot in the 2015 version of QuickBooks to see if anything has changed.

Until then, the only way to do this would be to look at what hasn’t been billed, then change the dates to be the current billing period and manually add that line item to your invoice.

Hi Nancy, thanks for the great article! I have a follow-up. We have everything setup as you mentioned so that we can track workers comp by job. The problem we’re having is actually dumping each job’s workers comp expenses to the customer’s bill. When we run a “what hasn’t been billed” report, all the workers comp shows up there as being unbilled, which we want to remedy by actually billing it out to the customer, but I can’t figure out how to do that. Am i missing something?? The costs don’t show up as being available to add into the invoice. I can think of a couple work-arounds, but I feel like there’s got to be a way to just bill out the workers comp lines that already show up. I’ve googled and googled and haven’t come across anything close to helping, which leads me to believe maybe I’m missing something SUPER simple, haha. thoughts????

Mark

You would set up the employee portion as a QuickBooks DEDUCTION payroll item type {using the same type of settings as the company piece – especially with rate and annual limits}.

As for a QuickBooks Report to get hours – you “could” use a payroll summary report for the time period showing hours & wages – OR – depending on your version of QuickBooks go to the Reports menu -> Jobs, Time & Mileage -> Time by Name Report.

If you have any additional questions, please feel free to contact me for assistance.

Nancy

Great article Keith, how would I set up the employee portion of this contribution? When it comes to pay L&I what report would your recommend I run to get the hours

Thanks

Hi Keith

I think you are correct that Washington State is the only state that bases Worker’s Comp on hours worked. There are several other states where there is both an employer and employee contribution to a state run worker’s comp fund, but those are based on a percentage of gross, if I remember correctly..

This is how I set up worker’s compensation including the deduction for the employee portion for my Greater Seattle clients (Washington State is the only state I believe that allows this). It is nice to see something I can give to their bookkeepers and owners.