Calculating and displaying retainage on an AIA G-702/G-703 form can be confusing – this short tutorial is designed to discuss different ways that retainage (or retention) can be held, calculated, and displayed.

Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project.

- a fixed percentage of the contract – such as 10% of the value of the contract

- a variable rate – such as 10% of the contract until the contract is 50% complete; at which time it is then reduced to 5%

- a variable rate – such as retainage is held at 10% on labor and 0% on materials

Retainage clauses are usually found within the contract terms outlining the procedure for submitting payment applications. A typical retainage clause parallels the following language: “Owner shall pay the amount due on the Payment Application less retainage of [a specific percentage].

The amount of retention that is held quite often signifies a portion of the contractors overall profit on the construction project.

Some accounting professionals, who don’t understand construction or the whole retainage/retention process often recommend that a contractor either:

- delay holding the retainage until the project is completed, OR

- hold the full amount of retainage on the initial billing

Nether of these methods is correct.

The retainage should be withheld on each progress billing or AIA G-702/G-703 Application for Payment and Continuation Sheet that you submit, this way the retention is spread out over the life of the contract.

Calculating a fixed or flat 10% retention

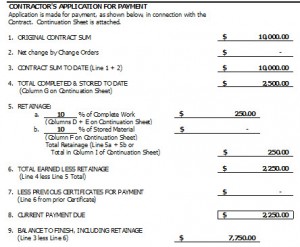

Let’s assume that you have a contract with a total value of $10,000.00 with retention held at 10%. The first progress invoice or AIA Billing that you create is for 25% of the job or $2,500.00. You would indicate that you were billing for the FULL $2,500.00 LESS the 10% retainage ($250.00) and that you were requesting a payment of $2, 250.00.

The G-702 Contractors Application for Payment would display the billing data as shown in the screenshot below:

Calculating and displaying retainage/retention on an AIA G-702/G-703 can be complex, especially if you are doing them manually. If you use QuickBooks and need to produce the AIA G-702/G-703 and are currently doing your billing using Excel spreadsheets – look into automating this process through the use of Construction Application for Payment Solution, find out more and request a free, no obligation 30-day trial.

We hope you found this tutorial to be helpful, if so please take a moment to leave a comment, share it with others on your favorite social media platform, or Subscribe to QuickBooks for Contractors blog via email to receive tips just like this.

Hi Robert

I’ve seen contracts with and without this stipulation – more often retainage is held on stored materials than not, mainly because the materials are put into place by the next billing period and it’s just easier to track the retainage when the materials are billed for as stored than it is to include the retainage when it is put in place.

is it common to hold retainage on material on site?