When entering bills, checks, or even credit card purchases in QuickBooks you have the choice to use an Items or Expenses tab – choosing the Items vs. Expenses tab will depend on what the money being spent was for.

Because you do you a choice to use an Items or Expense tab when entering transactions in QuickBooks; many people often use the Expense tab – but it may not always be the correct choice.

QuickBooks terminology can sometimes be VERY confusing!

An Item is:

Anything that your company buys, sells, or resells in the course of your business. An Item could be products, goods, services that you purchase from others.

Yes, this is vague – but think about the various line items that you use to create an Estimate, an Invoice, a Sales Order, or even a Purchase Order.

Those things are your Items, they live in the QuickBooks Items List and they help you to complete these types of forms.

When you add something to the Items List in QuickBooks you can (and should) set it up so that it can capture not only the money you pay to purchase it but the money that you receive when you sell it – this is especially important if you want or need to do any sort of job costing.

It’s only natural that when you pay for these things that you enter their costs under the Items tab.

An Expense is:

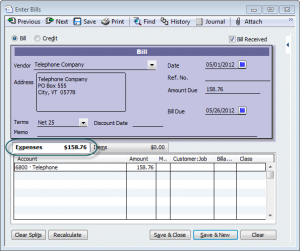

Anything that your company spends money on that keeps it up and running. An Expense is rent, phone bills, website hosting fees, office supplies, accountant fees, trash service, janitorial fees, etc.

These things do not generate any income for your business, but they do keep your business running.

When you enter the costs associated with these things you enter them under the Expenses tab.

So, the next time you sit down to enter a bunch of bills, write checks, or enter credit card charges – ask yourself this question:

Is the money I’m spending on this associated with a job, a sale, a client, or a customer?

If the answer is yes – use the Items tab.

If the answer is no – use the Expenses tab.

Hello Warren – thanks for stopping by! I checked out your site as well – good content! Contractors today, more than ever I think, need all the help and information that they can get!

Great Site!

My website, “minority contracting success,” is set up for new and existing contractors trying to survive in today’s economy. I feel that your site will be very helpful to my readers and clients.

I will be recommending your site to my readers!

Thanks,

wl reidhead