An updated Form I-9, Employment Eligibility Verification form was released by the U. S. Citizenship and Immigration Services on May 8, 2013.

Important Note: If you hire a person for less than 3 (three) business days, the entire form must be completed on the date of hire.

As a business owner, you are required to keep the completed Form I-9 on file for as long as the employee works for you. Once the employee no longer works for you, you are still required to keep the completed form for a period of 3 years from the date of hire – OR – one year after employment is terminated; whichever is longer.

Downloads:

- Newly updated Form I-9 – complete with basic instructions for completion.

- Handbook for Employers – your complete guide to the I-9, includes information about document retention, unlawful discrimination and penalties for prohibited practices, E-Verify; the web-based verification companion for Federal contractors, frequent questions, and more

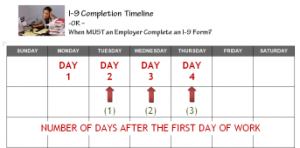

- Our I-9 Completion Timeline Quick Reference guide

According to an article that I read in the CPA Practice Advisor:

Mistakes or missing information, whether intentional or not and which might have nothing to do with a worker being in the country illegally, can lead to stiff penalties. Employers can be fined from $110 to $1,100 per violation for failing to comply with the form’s requirements, according to U.S. Citizenship and Immigration Services. Penalties can be even steeper, up to $6,500 per violation, for participating in document fraud, or up to $16,000 for knowingly hiring an unauthorized worker.