The Balance Sheet by Class Report was first introduced with QuickBooks 2011, however, it is also available in QuickBooks 2012, 2013, and 2014; has specific requirements for handling many or our normal day-to-day transactions. This will enable QuickBooks users to perform divisional accounting with QuickBooks, which was previously impossible or required significant duplication of effort.

In our previous article, QuickBooks 2011 – New Balance Sheet by Class Report – Part 1, we touched briefly on the fact that transactions will have to be entered in a very specific manner and there are many data entry transactions that are not supported by the Balance Sheet by Class Report.

The first limitation that we will discuss is Journal entries with “unbalanced” classes. This limitation will affect CPA’s and other accounting professionals; and will require that they change the manner in which they create journal entries in client files – if they or their client chooses to use the Balance Sheet by Class Report.

An “unbalanced” journal entry occurs when you as the CPA or other accounting professional creates a journal entry that changes ONLY one side of the balance sheet for a specific class. This creates an “unbalanced” balance sheet for the class.

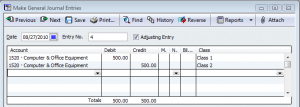

For example, your company purchased some computers, and you want to create a journal entry moving $500.00 worth of the computers from Class 2 to Class 1. You would normally create a journal entry as follows:

| Account | Debit | Credit | Class |

| Computer & Office Equipment | 500.00 | Class 1 | |

| Computer & Office Equipment | 500.00 | Class 2 |

While the overall entry balances – meaning debits equals credits – from the “class” perspective the entry is NOT in balance because it increases assets in Class 1 while decreasing assets in Class 2. When using classes in Journal entries Debits MUST equal credits for EACH class.

Procedure to “balance” the journal entry

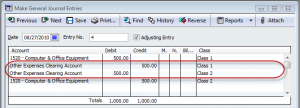

You will need to make a journal entry where debits equal credits for each class. This procedure will require accountants to perform additional data entry and change their journal entry procedures.

To do this, in your chart of accounts create an Other Expense type account called Other Expenses Clearing Account. Once you have created the account you will then use it to balance the classes in the journal entry, like this:

| Account | Debit | Credit | Class |

| Computer & Office Equipment | 500.00 | Class 1 | |

| Other Expenses Clearing Account | 500.00 | Class 1 | |

| Computer & Office Equipment | 500.00 | Class 2 | |

| Other Expenses Clearing Account | 500.00 | Class 2 |

Just remember, that the balance in the Other Expenses Clearing Account should ALWAYS be zero – debits and credits (or money in & money out amounts) are equal.

View this video by Intuit demonstrating the Balance Sheet by Class Report in action.

Our next article will discuss how to handle paychecks that are allocated to multiple classes.

NOTE: Most of the information contained in this article has been based on information found in the QuickBooks In-program help. Intuit has done a very good job documenting the required procedures to successfully implement the Balance Sheet by Class Report.

|

Request our FREE 142-page “What’s New in QuickBooks 2011? eBook, by completing a simple request form.

This eBook will provide you with with all the information I’ve posted here in our blog, plus MORE! Once you’ve completed our simple request form, you’ll have instant access to this 142-page .pdf eBook, designed to be duplex printed and put in a binder for future reference. |

[…] many data entry transactions that are not supported by the Balance Sheet by Class Report; and in QuickBooks 2011 – New Balance Sheet by Class Report – Part 2, we discussed how accounting professionals and end users would need to change their procedures when […]

Mike, I’m contacting you privately, I’d like you to provide me with a screen shot so I can “see” what you are talking about. That way we can come up with a resolution. You may want to check your spam or junk mail folder, quite frequently that’s where I end up for most comcast users.

This “other” category is a pain in the neck! How do we remove it from reports and get back to the regular reports that were uncomplicated? I don’t want every category to have an “other” because those rows of “0.00” add over a page to my report wasting hundreds of pages when the report is copied.

Penny, you are correct – QuickBooks won’t stop you or insist that you have equal debits and credits when making a journal entry of this type.

While I don’t have any insight as to why Intuit says in the help file that you have to equal debits and credits for each class; I can only assume that they feel it is two separate actions.

The first action being to remove $500.00 worth of computer equipment from Class 1 (which requires a debit and a credit) and the second action is to add the $500.00 worth of computer equipment to Class 2 (another debit and credit).

I’ll see if I can get anymore insight to your question from a contact that I have at Intuit.

I first want to say, thank you for exploring these important details. I am really missing something on this one, so I figure other people might be too. The part that is throwing me off is the need to have equal debits and credits for each class. I have not run up against this limitation using classes with the Profit and Loss accounts, and QuickBooks 2011 didn’t stop me from creating the first JE you describe, in other words, the system doesn’t insist you have equal debits and credits for each class. Can you help me understand why you would need the clearing account?

[…] 2011 – New Balance Sheet by Class Report – Part 2, we discussed how accounting professionals and end users would need to change their procedures when […]

[…] QuickBooks 2011 – New Balance Sheet by Class Report – Part 2 QuickBooks 2011 – 10 Tips for a Successful Installation/Upgrade […]

[…] 2011 – New Balance Sheet by Class Report – Part 2, we discussed how accounting professionals and end users would need to change their procedures when […]