The Balance Sheet by Class Report was first introduced with QuickBooks 2011, however, it is also available in QuickBooks 2012, 2013, and 2014; has specific requirements for handling many or our normal day-to-day transactions; it gives users the option of selecting “Classes” (fund, location, profit center, or other category) as their column/class grouping.

Over the last several days, I’ve been discussing and sharing some information about how we all will need to change our data entry procedures in order to utilize the Balance Sheet by Class Report available in QuickBooks 2011.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 1, we touched briefly on the fact that transactions will have to be entered in a very specific manner and there are many data entry transactions that are not supported by the Balance Sheet by Class Report

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 2, we discussed how accounting professionals and end users would need to change their procedures when creating journal entries so that they were balanced

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 3, we discussed how users and accounting professionals would no longer be able to assign multiple classes to a single paycheck.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 4, we discussed how you would need to classify Payroll Liability Payments in order for them to be appropriately recognized on the final report.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 5, we discussed how you need to classify Sales Tax Liability Payments using a Journal Entry AFTER you actually make the payment.

- QuickBooks 2011 – New Balance Sheet by Class Report – Part 6, we discussed the effect of handling customer prepayments when using the Receive Payments window.

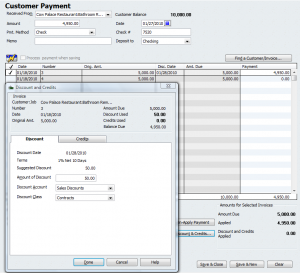

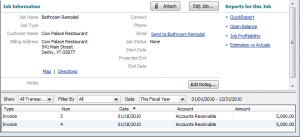

In this article, we’ll talk about invoices with multiple classes and how offering customer discounts in the Receive Payments window cause discrepancies between the Profit & Loss by Class and the Balance Sheet by Class reports.

Business owners who offer early payment discounts to their customers will need to carefully review their billing procedures, especially if they frequently create a single invoice to a customer which contains multiple class assignments.

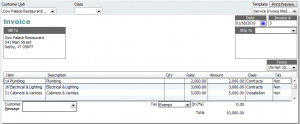

For example, let’s say that you create an invoice as follows:

| Description | Amount | Class |

| Plumbing | $2,000.00 | Contracts |

| Electrical & Lighting | $3,000.00 | Contracts |

| Cabinets & Vanities | $5,000.00 | Installation |

A net income difference between the Balance Sheet by Class and the Profit & Loss by Class reports occurs when the customer pays you and you use the Receive Payments window to record an early payment discount, because you can only assign a single class to the discount.

The Profit & Loss by Class report shows the full amount of the Discount ($100.00) in the “Unclassified” column of Net Income.

While the Balance Sheet by Class Report allocates the discount based on the classes from the original invoice.

The only solution is to enter a single class for each invoice, this also means, based on our example, that you would have to create two different invoices for your customer; one for $5000.00 assigned to the Contracts class and another for $5000.00 assigned to the installation class.

This also means that you will have to receive two payments from the customer, even if they send you a single check, so that you can properly apply the correct class to the discount.

When discounts are handled in this manner, the Profit & Loss by Class report accurately reflects the discount for each class.

And the Balance Sheet by Class accurately reflects Net Income.

While this is an adequate work around, it is my opinion that it increased the work load and will be a very unattractive solution for most businesses because it will double the time it takes to bill customers and receive payments.

|

Request our FREE 142-page “What’s New in QuickBooks 2011? eBook, by completing a simple request form.

This eBook will provide you with with all the information I’ve posted here in our blog, plus MORE! Once you’ve completed our simple request form, you’ll have instant access to this 142-page .pdf eBook, designed to be duplex printed and put in a binder for future reference. |

[…] QuickBooks 2011 – New Balance Sheet by Class Report – Part 7 […]

[…] This post was mentioned on Twitter by Quickbooks News, Nancy Smyth-Sunburst. Nancy Smyth-Sunburst said: QuickBooks 2011 – New Balance Sheet by Class Report – Part 7 https://goo.gl/fb/35cZC […]