QuickBooks Payroll, when properly set up, is capable of tracking and including the cost of your General Liability Insurance; as well as many of the other things that costly construction software does automatically – with a little more effort on your part and without the big price tag.

NOTE: The best time to implement this procedure is when your General Liability Insurance Policy period starts.

The following instructions will allow you to track your General Liability Insurance costs when it is based on gross payroll and get those costs into your job costing reports without making complex journal entries. It will also help you be aware of how much your premium payment will be so that you aren’t in for an unwelcome surprise when the bill comes in or your policy is audited.

QuickBooks Setup for accruing the cost of General Liability Insurance

Example:

In our example general liability insurance is calculated at $6.36 per $1,000.00 in wages for field workers – realize that each type of work that you perform could very well have a different experience rate (just like Worker’s Comp).

Step 1:

Come up with a rate per $100 in wages so this can be calculated for each employee with each paycheck, if paychecks are usually less than $1,000.00 per employee per week.

- $1,000.00 divided by 10 = $100.00

- $6.36 divided by 10 = $0.636

If your policy has different experience rates for different work or employee classifications you’ll want to determine this cost for each different rate.

Step 2:

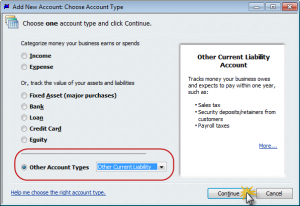

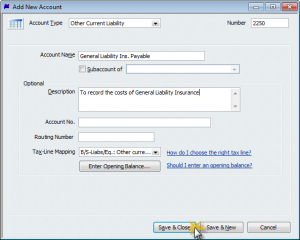

Create an Other Current Liability Account on your Chart of Accounts to track your Accrued General Liability Insurance. From the Lists menu –> choose Chart of Accounts –> click the Account button at the lower left –> click New –> select the radio button next to Other Account Types and choose Other Current Liability from the drop down menu.

Click the Continue button and add the details for the account.

Click Save & Close.

Step 3:

Create the Cost of Good Sold and/or Overhead accounts to track the expense to the company. A Cost of Goods Sold account would be used for field workers and an Expense Account for Overhead and Office workers. From the Lists menu –> choose Chart of Accounts –> click the Account button at the lower left –> click New –> select the radio button next to Other Account Types and choose Cost of Goods Sold from the drop down menu – OR – click the radio button next to Expense.

Click Save & Close.

Step 4:

Create Company Contribution Payroll Items to track the costs while running payroll. From the Lists menu –> choose Payroll Item List –> click the Payroll Item button at the lower left –> choose New –> select Custom Setup –> click Next –> click Company Contribution –> click Next –> type in the name for this item and select the Track Expenses by Job option –> click Next –> choose your General Liability Insurance Carrier –> from the Liability Account drop down select the account you created in Step 2 –> from the Expense account drop down select the account you created in Step 3.

Click Next –> Tax tracking type should be set to None –> click Next –> Taxes window should have no tax types checked –> click Next –> Calculate based on quantity window select the radio button to Calculate this item based on quantity –> click Next –> Default rate and limit window, enter the amount that you calculated in Step 1 and make sure that the This is an annual limit option is NOT checked. Click Finish.

Step 5:

Add the company contribution item(s) to Employee Defaults so all new employees who are hired will automatically have this item automatically included in their employee records.

From the Edit menu –> choose Preferences –> select Payroll & Employees –> click on the Company Preferences tab –> click the Employee Defaults button –> click into the Item Name column of the Additions, Deductions and Company Contribution section and select the item(s) you created in Step 4.

Step 6:

Add the company contribution item(s) to existing Employee Records in order to calculate your accrued liability when processing payroll.

From the Employee Center, edit each employee record going to the Payroll & Compensation tab –> click into the Item Name column of the Additions, Deductions and Company Contribution section and select the item(s) you created in Step 4.

Calculating General Liability Insurance Costs When Running Payroll

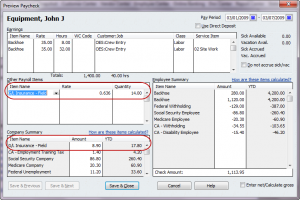

When running payroll you’ll want to open (view) the detail of each employees paycheck –> determine gross payroll ($280.00 + $1,120.00 = $1,400.00 – per the sample paycheck below) –> take total gross and divide it by 100 (1,400.00 divided by 100 = 14) –> enter 14 in the Quantity column next to the company contribution item and click Enter. QuickBooks will then calculate the General Liability Insurance for this employee and display that amount in the Company Summary section.

By implementing and following this procedure your General Liability Insurance will be included in your Payroll Summary Reports, Profit & Loss, and Profit & Loss by Job Reports. Additionally, your accrued liability will be displayed on Balance Sheet Reports and can be viewed at any time simply by viewing your Chart of Accounts List.

One final note; when it’s time to pay your General Liability Insurance policy premium you will cut the check using the payroll Pay Liabilities function – DO NOT USE the Write Checks feature.

Gina, this one is ICKY! There are 2 ways to deal with this:

You might want to have your accountant help you out with the second option so that things get posted correctly.

Hi

GL insurance can either be based on gross payroll or gross sales/total bid price. You’d need to check with your insurance agent and then handle the tracking accordingly.

Very informative article. Thanks!

Is GL insurance also based on direct job costs such as all materials, labor (COGS)? Our estimator includes insurance based on projected costs on all his bids using a multiplier factor.

I’m getting feedback from a bookkeeper the GL rate is based on total bid price. That doesn’t sound logical at all.

What’s been your experience on this matter?

I set this up a year ago, but was paying the insurance carrier through entering and paying bills in the A/P section. How do I reverse all these payments to that the accrual of the Workmen’s Comp and G/L is reduced by my payments?