A QuickBooks tip for creating a job cost report that displays hours worked and payroll/labor burden costs.

Creating a job cost report displaying the hours worked by employee, on a specific job or on all jobs, for a specific week or at the end of a job which includes payroll/labor burden costs can provide a contractor with vital job costing information so you can see if you correctly bid the number of man hours and payroll costs required on a job.

Creating a job cost report displaying the hours worked by employee, on a specific job or on all jobs, for a specific week or at the end of a job which includes payroll/labor burden costs can provide a contractor with vital job costing information so you can see if you correctly bid the number of man hours and payroll costs required on a job.

NOTE: It is highly recommended that you start with a single pay period AND a single paycheck to ensure that your report is correct. Once the report is correct, memorize it and you can then either finish your payroll or change the dates to better suite your needs.

- From the Reports menu -> choose Custom Transaction Detail Report (the Modify Report:Custom Transaction Detail Report window may or may not automatically appear; if it does not, click the Modify Report button)

- On the Display tab, navigate to the Columns section and using the scroll bar on the right of the window select (click) only the following options – Date, Num, Name, Source Name, Item, Payroll Item, Qty, Sales Price, Amount and Balance. All other items in this list that were preselected should be unchecked.

- Click on the Filters tab

- in the Choose Filter block, click on Transaction Type -> from the Transaction Type drop down menu select Paychecks

- still in the Choose Filter block, click on Account -> from the Account drop down menu -> select Multiple Accounts -> and click on each of your Payroll Expense or Payroll Cost of Goods Sold Payroll Costs accounts.

- Click the OK button.

Print your Report – but do not close it yet:

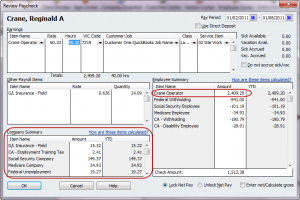

Compare the report to the employees paycheck – making sure that ALL of the amounts from the Company Summary section of the Paycheck Detail are included in your report.

If all of your costs are included, return to the report, click the Modify Report button -> click on the Header/Footer tab -> change the Report Title to Job Cost Report with Hours & Payroll/Labor Burden Costs -> click OK. Next click the Memorize button and save it.

You can now pull up the memorized report at any time and make further modifications for a specific date range or even a specific job.

To run the memorized report for a specific job:

- From the Reports menu -> choose Memorized Reports -> select your report

- Click the Modify Report button -> click the Filters tab -> from the Filters box -> click on Name -> from the Name dropdown menu select just the specific job

- From the Dates drop down menu -> select All

- Click the Refresh button

This will produce a report just for this specific job and include all payroll/labor burden costs to date. This is a valuable report to run at the end of a job.

We hope you found this QuickBooks tip for creating a job cost report which included hours and payroll/labor burden costs helpful. If so, please take a moment of your time to leave a comment.

Author’s Note: The idea for this post originally came from Ruth Perryman – however, it has been modified to include additional instructions and details.

You’re welcome!

Thank You!

Marion

QuickBooks Enterprise has a Committed Costs report that will show gross wages, but there is not a built-in report in Pro or Premier.

Tina

Recheck the steps to create the report, especially Step 3.

Nancy

Hi Nancy

CA-Unemployment Company and Workers Compensation are the last two line items shown on your report. When i follow the steps above and select ALL payroll expenses, these two line items do not show on my report. Workers comp is an important labor burden, how do i get this to show on my report as well?

Is there any way to get up to date payroll costs on a job prior to the paychecks being cut?

Colleen

Company paid payroll taxes are included in this report with the instructions provided. Enlarge the first screen shot and look at the Payroll Item column on the screenshot.

Is there a way to include the payroll taxes associated with the job hours on this report?

Hi Lucinda

I’m so glad that you found this report helpful – for a lot of companies payroll is the biggest expense and it’s important to know just how much of the actual job itself is just payroll!.

Nancy, This is one of the best reports that I have seen to capture the hourly costs per job. Thank you!

[…] Create a QuickBooks Job Cost Report With Hours & Payroll Costs (QuickBooks for Contractors blog): Job costing is a great feature of QuickBooks, but one that is complicated to use in some cases. This is a great tip! […]