Billing employee time on customer invoices is something that many business need to do – not just contractors who perform Time & Materials Billing. Making sure that you bill all of the time your employee(s) have spent working on specific jobs or tasks for customers is crucial and depends data that you’ve entered in QuickBooks. Here’s a question from a reader.

Thanks for the tips.

I’m used to using the “Unbilled costs by job” report, however I am stumped when it comes to billable hours I’ve entered using the timesheet function. How do I tell if I need to create an invoice for a client to bill them for hours entered? Those hours do not show up on the “Unbilled costs by job report” !!

Any help would be greatly appreciated. Nick

Hi Nick

Thanks for stopping by and submitting a question.

Actually, your question confused me and I’ve had to do some research. I “think” I’ve discovered the reason why you aren’t seeing the information that you want in the “Unbilled Costs by Job” report (found by going to the QuickBooks Reports menu -> choosing Jobs, Time & Mileage -> and selecting the Unbilled Costs by Job report).

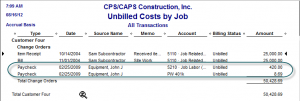

When I run an Unbilled Costs by Job report in any of my test files, I get employee time from paychecks that I’ve created in QuickBooks, see below:

So either you aren’t doing payroll (actually creating paychecks) in QuickBooks – or somehow you’ve modified the original report to exclude payroll.

If you aren’t running payroll in QuickBooks this would explain why those costs aren’t appearing in this report – but there is a backdoor method to find out the billing status of the time you’ve entered into timesheets.

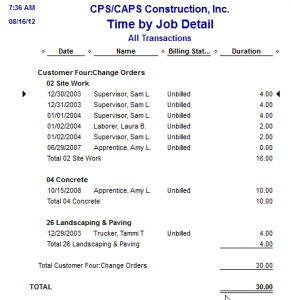

From the Reports menu -> choose Jobs, Time & Mileage -> and select the Time by Job Detail Report, this report will show you all the time you’ve entered by Customer/Client, Service Item, and Employee and how much time they spent; see below:

However, this only adds to my confusion. The time shown in the screenshot above does not have a paycheck associated with it (so doesn’t show up on the Unbilled Costs by Job Report), however, when I go to create an invoice, select this specific customer and go to the Time & Expenses option and click on the Time tab – those hours are displayed there. See below:

.

What version of QuickBooks are you using Nick? At this point I’m thoroughly confused!

Hi Nick

Thanks for responding – you’ve cleared up much of the confusion that I had.

Unfortunately, what we are dealing with here is a double-edged sword!

It sounds like you’ve outsourced your payroll – but need to have this vital information for job costing and billing purposes.

It also sounds like you are also now going the extra step of manually re-creating the paycheck (but skipping the timesheet piece).

Here are a couple of suggestions:

Then you can enter the time in the timesheet -> go to Pay Employees -> select the employees to pay -> make the taxes, etc. match whatever information you get from the payroll service and then you will have both the weekly timesheet information and the information you need/want to see in the Unbilled costs by job report.

If you’d like, contact me to arrange for an hour of one-on-one help. Using a combination of the phone and remote access software, I can log into your machine and we can dig into this deeper.

Thanks for the detailed and thoughtful reply.

I’m using QB Pro 2012. I do not use the actual payroll feature. Rather, I was entering time using the QB weekly timesheets, and that time would be marked as billable to my client. Then I click on my client and choose “create invoice” the time will appear and I can bill them.

My problem is that I have multiple clients w/ multiple jobs under each client, and without clicking “create invoice” on each job, I’d have no clue which jobs have outstanding billable hours as the timesheet hours don’t appear on the “unbilled costs by job” report, which is what I typically use to see which clients I need to create invoices for.

So far to combat this, in lieu of using the weekly timesheet, I’ve just been using the paycheck screen and marking the employee’s check as a billable item, which then shows up on the unbilled costs report. The downside is no weekly timesheet for each employee, but I still have record of their hours in the memo line of the paycheck in QB.

-Nick