QuickBooks Payroll and Certified Payroll processes really need to be efficient in order for a business to be successful. When one of your businesses largest job expenses is payroll, you need to:

- pay your employees correctly and on time to keep them happy,

- make sure that those payroll costs are part of your accounting system so those costs are included in job costing reports,

- and you need to submit your certified payroll reports accurately and in a timely fashion in order to be paid.

Yes, it’s a vicious cycle!

Ask any business owner how efficient he thinks his payroll and certified payroll processes are and I’m betting he’ll either say “oh they are very efficient” or “they could be better”. Ask his payroll clerk who is dealing with a lot of manual data entry and I bet that she’ll have a far different answer!

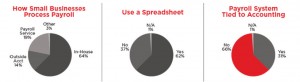

I attended a really great webinar a couple of weeks ago, called “A Tale of Two Payroll Processes” – given by CPA Practice Advisor and TSheets and I have to admit I was pretty surprised by one of the slides in the presentation – Processing Payroll: Industry Snapshot (shown below).

When I first looked at this slide, I thought “awesome” 64% of small businesses process payroll in-house.

But then I looked more closely:

- 62% use a spreadsheet, and

- 66% do not have a payroll system that is tied to their accounting software!

For some businesses using a spreadsheet or having a payroll system that isn’t tied to their accounting software might be ok – at first glance. If you are a contractor or any type of business that needs to track employee time against specific customers or jobs and tasks or cost codes – then using a spreadsheet or a payroll system that isn’t tied to your accounting software isn’t efficient at all.

Payroll is a HUGE part of the cost of running a business and for many business type’s payroll is one of the largest portions of the cost of doing a job.

I know that many business owners who use QuickBooks will often use an outside payroll service to handle payroll – my question are:

- • if you need job costing how are you getting those payroll costs into QuickBooks

- • how are your certified payroll reports being created

- • And then how efficient are the processes?

Payroll that is not tied to or part of your accounting system and certified payroll reports that are issued manually using complex Excel spreadsheets or fillable forms are time-consuming, tedious, error-prone and above all else disconnected from the rest of your financial data. This makes it difficult to obtain accurate and error-free financial information, because you are always having to enter the same information in multiple places.

If this sounds familiar and you would like to learn how to automate your payroll and certified payroll processes – join me tonight from 5-6 EST on Google+ for a 1 hour hangout called the Tale of Two Certified Payroll Processes, where we’ll compare the manual vs. the automated processes of entering employee time, generating paychecks, and finally creating certified payroll reports, EEOC and union dues and fringe benefit reports. Can’t make the live hangout – that’s ok, it will be recorded and I’ll post the link so you can watch it on YouTube.

Below is the recording on YouTube of the hangout, it was a lot of fun!

James

I’ll be hosting a 1 1/2 hour webinar on QuickBooks Job Costing from A-z on Wednesday March 26, 2014 from 1-2:30 p.m. EST. For more information and to sign up, click here.

Hi Deb

Thanks for such a glowing review 🙂

To any who are considering whether or not this is worth it to them to check out all I can say is

YES!!!!!

I work for a construction contracting company where we are required to produce certified payroll reports for upwards of 20-40 jobs each week. We have been using the certified payroll software for about 4 years and it is truly worth every penny and more! (And it really doesn’t cost that many pennies.) In addition Nancy & Ben & Company provide exceptional support. I really cannot recommend this product highly enough.

That’s awesome 🙂

Have a great day.

Absolutely include me on your job costing webinar contact list! I will also try to be on the Google+ call today.

James

I hope to have a webinar ready next month on QuickBooks job costing – I can let you know when it will be available if you’d like.

In the meantime – here is a link that will provide you with several job costing articles here on the blog.

Nancy, which of your webinars, training, etc., would be best for learning job costing within QuickBooks? I just upgraded to Enterprise which I have used before but not in a job costing capacity.

Hi James

Sounds like you have your work cut out for you! These manual processes are horrible!

Glad that you found this post helpful! Good luck with the task of automation 🙂

Hi Nancy, I am the new controller at an engineering firm and the process you described above is exactly what has been occurring and is still being done until I can change the process. In addition we need it for job costing purposes which has not been done in the past either. So your timing of this blog was absolute perfection.