Change Orders are a fact of life that a contractor must deal with on just about every construction project that they are involved with.

There are many ways in which people will handle Change Orders when using QuickBooks, such as just going to the original Estimate and changing the dollar amounts of the affected items. This is a “quick and easy fix”; however, it doesn’t leave a good documentation trail for what occurred on the project and can cause a lot of confusion.

Handling change orders that increase the value of the contract can be accomplished by:

- Editing the original Estimate and ADDING lines to the bottom indicating the cost codes and dollar amounts that are causing the increase.

- Creating a Sub-Job of the Job called Change Order 1 (2, 3, 4, ect.) and creating an estimate at the Sub-Job level to track just the cost codes involved in the change order.

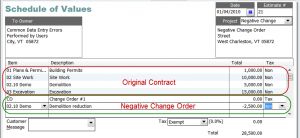

Dealing with Negative Change Orders that reduce the original bid amount, is a bit more difficult – because QuickBooks will not allow you to create a Negative Invoice.

When you receive a negative change order that is LESS than the remaining balance on the contract, it’s a fairly easy process.

- Go to your QuickBooks Estimate, add a Change Order Item with no dollar amount – this provides a clear separation of the Original Contract amount.

- Below that add the Item that represents the reduction to the contract, enter the value as a negative amount, complete with the MINUS sign.

When you are ready to prepare your next progress invoice:

- Bill the negative amount at 100%.

- Reduce the corresponding line item in the original contract section.

- Bill for any other line items that you need to.

Or simply generate a zero dollar invoice to record the reduction.

This method allows for a good documentation trail that everyone involved can easily see.

[…] charges after a job is billed at 100% or even a negative change order during the project makes for a lot of extra work in order to make the “numbers” add up […]

Hi,

I would like to get help with a electrical contractor I am helping. Would you call me at my office. 847-991-8888.

Bob Dix

Connie

That’s a great question-which unfortunately has MANY possible answers.

If retainage has been held, sometimes the “credit” is held from that -> in QB you would issue a credit memo for this just using the items that the materials related to.

If they want an AIA draw showing the credit I would probably delete the last progress invoice and follow the steps outlined above.

If you use a software program to do your AIA billings – it should have a way to create a negative application for payment. Our AIA Biling add-on for QuickBooks has that capability.

I hope this helped.

so what do you do if you billed out the whole job, and the GM says, you owe him a credit back cause he supplied certain materials, how do you fix QB and AIA billing? There is no balance to offset a credit with, because everything was previously billed 100%