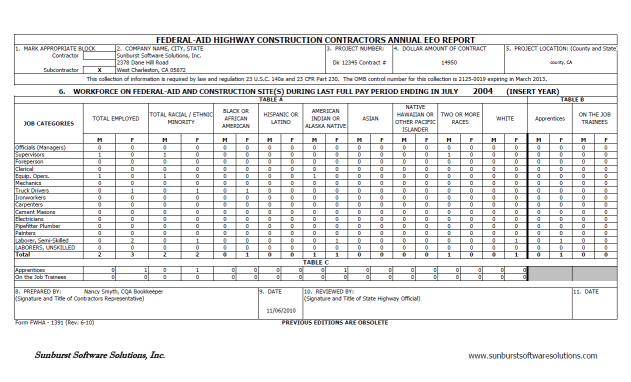

EEOC Reports & Government Funded Construction Projects – Q & A

EEOC Reports are just another compliance requirement that must be met when you perform work on government funded/prevailing wage jobs - in addition to the submission of a weekly certified payroll report. In this Q & A we'll discuss your obligations, what types of forms you might need to file, and when you have to file them. What is the EEOC and what do they do? The U. S. Equal Employment Opportunity Commission (EEOC) is responsible for enforcing federal laws that make it illegal to discriminate against a job applicant or an employee because of the person's race, color, religion, sex, national origin, age, disability or genetic information. What is an EEOC Report? An EEOC Report is really nothing more than than a report that includes how many employees you…