How To Turn On and Use Manual Payroll in QuickBooks

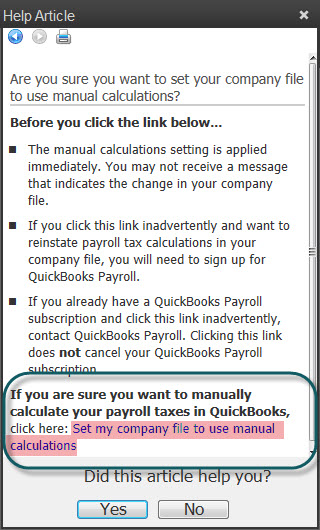

We are a small company and are looking at various options for payroll; I've heard that there is a way to do payroll manually in QuickBooks, but I can't seem to find any information on how to turn on that feature, everything seems to indicate that we have to buy a payroll subscription and that just isn't in our budget right now. Can you help? Thanks in advance. --------------------------------------- How to turn on and use the manual payroll option in QuickBooks certainly feels like a highly guarded secret. Intuit makes a lot of money selling payroll subscriptions and rightly so as keeping up with payroll tax laws and forms in each and every state is a lot of work! Even so, there are instances when a business chooses to have…