Generating weekly certified payroll reports when you issue bi-weekly paychecks to your employees can be difficult unless your accounting software will accurately accrue the wages for each week – QuickBooks doesn’t have this ability and quite often this causes problems.

Under the Federal Davis-Bacon and related Acts; contractors and subcontractors performing work on Federal or Federally-aided construction-type contracts are required to submit weekly payrolls. The Copeland Act provides further/clearer requirements; indicating that contractors and subcontractors performing work on Federally financed or assisted construction contracts “furnish weekly a statement with respect to the wages paid to each employee during the preceding week”.

Obviously, contractors and subcontractors who issue their payroll on a weekly basis find the necessary information easier to obtain; therefore, making compliance of certified payroll reporting easier on the people who actually have to complete the reports.

What happens when your company is subject to the rules found in the Davis-Bacon and the Copeland Act and you issue your payroll on a bi-weekly basis?

I’m not here to tell you that you HAVE to start issuing your paychecks on a weekly basis – I’m only here to tell you what the requirements are and about what COULD happen – based on my experience; so that you can make an informed decision.

If you are lucky enough to have an accounting program that accurately accrues and distributes payroll taxes and wages based on when it is earned rather than when it is paid – you shouldn’t run into any issues when you create the certified payroll reports. BUT, if you use QuickBooks you need to be aware that it does not have this ability and your payroll is recognized only when you actually issue the paycheck and this is where the problem with your certified payroll reports COULD begin.

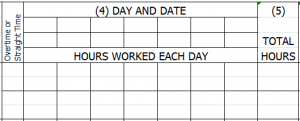

Each certified payroll report has a weekly calendar section {shown below} where by day and date you enter the number of hours that each employee worked on the prevailing wage job site and the total hours that he/she spend there during the entire week.

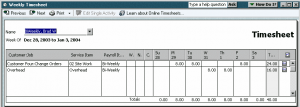

When you issue payroll in QuickBooks on a bi-weekly basis – you will enter the time worked for each of the two separate workweeks in two individual timesheets, for example, let’s say that your pay period ends on a Saturday:

- Your first work week covers Sunday, December 21, 2003 through Saturday, December 27, 2003

- Your second work week covers Sunday December 28, 2003 through Saturday, January 3, 2004

- Your paychecks will be dated on January 7, 2004

Below are the two timesheet entries from QuickBooks:

- Workweek 1 has 24 hours on the Prevailing Wage Job and 16 hours on a non-prevailing wage job

- Workweek 2 has 24 hours on the Prevailing Wage Job and 16 hours on a non-prevailing wage job.

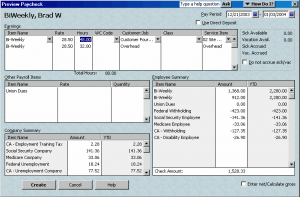

Next, we’ll look at the QuickBooks paycheck detail, you’ll see that the total number of hours are accurate for the full two weeks.

- A total of 48 hour at $28.50 per hour for $1,368.00 in wages for the prevailing wage job

- A total of 32 hours at $28.50 per hour for $916.00 in wages for the non-prevailing wage job

- Total gross for the 2 week period of $2,280.00

- Net wages for the week $1,528.33

When you create or run your certified payroll reports {whether is is with our Certified Payroll Solution software or using the built-in QuickBooks certified payroll report} you’ll need to generate two individual reports; one for each week. This is what the reports will look like:

- Week 1 – the hours are correct {24} and the rate of pay is correct {$28.50} BUT the gross amount earned This Job/All Jobs represents the FULL amounts from the bi-weekly paycheck {$1,368.00/$2,280.00} instead of $684.00 this job/ $1,140.00 All Jobs which was actually earned for this specific workweek.

- Week 2 – again, the hours are correct {24} and the rate of pay is correct {$28.50} BUT the gross amount earned This Job/All Jobs represents the FULL amounts from the bi-weekly paycheck {$1,368.00/$2,280.00} instead of $684.00 this job/ $1,140.00 All Jobs which was actually earned for this specific workweek.

Is this wrong? Well, sort of; the laws do indicate that payroll should be reported {therefore, issued} for the preceding week.

What can you do if you issue payroll on a bi-weekly basis?

Many of our own customers issue payroll on a bi-weekly basis, and on the Statement of Compliance {in the Remarks section} they add a note that indicates that they issue paychecks on a bi-weekly basis and while the certified payroll report accurately reflects the correct number of hours worked on the job for the specified week; gross amounts earned This Job/All Jobs, deductions {including taxes and other withholdings} and Net Pay reflect the full amounts from the single bi-weekly paycheck.

Will this statement keep you out of trouble?

Not necessarily, it all depends on the Contract Administrator and Awarding Agency.

The best thing to do, in my opinion, is to just bite the bullet and issue your payroll on a weekly basis; at least for the employees who work on the prevailing wage projects. This may mean some additional planing and scheduling on your part, but it’s easier than having your certified payroll reports rejected and having to manually calculate the gross, taxes, deductions and net pay and resubmit the reports!

Look for similar articles next week on how a semi-monthly or monthly payroll run will affect your certified payroll reports.

I hope that you’ve found this article to be informative and helpful in making informed decisions for your business; if so please take a moment to leave a comment or to share this with others on your favorite social networking platform using the buttons below.