QuickBooks has no built-in ability to handle stored materials, like many of the more costly construction specific software programs. This causes problems for contractors who need to generate AIA Pay Apps and need to make sure that their books (or accounting data) syncs with their AIA Applications for Payments. This question was originally asked on the Intuit Community forums.

————————————————————————————–

Best Practice for Handling Stored Materials and AIA Pay Apps

Because the General Contractor allows billing of stored materials on the AIA Payment Application you also need to include the amount of stored materials on your QuickBooks Progress Invoice in order for your accounting records to match your AIA billing records.

Here is an example of how you would handle it, both in QuickBooks and on the actual AIA Pay App.

Let’s say that you have a job where you are installing a large bricked patio and walkways with some decorative fountains and benches in a park. The scope of work involves Site Work, Excavation, Concrete, Masonry, and Specialty Items (the fountains and benches). We’ll focus on the Specialty Items in this example. Your Original Contract Amount for the Specialty Items (the amount you will be billing the GC for just those items) totals $43,460.00. The Vendor that your ordered the Specialty Items from delivers two fountains and a bench to the job site – but you aren’t quite ready to actually install or place them just yet – they become Stored Materials (because they are actually on the job site but not yet in place). It’s time for you to generate your monthly pay application and you will be billing your GC for 50% of the original amount of the Specialties line item.

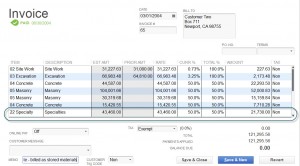

On your Progress Invoice, you’ll bill for $21,730.00 (50% of the Specialties line item) PLUS any completed work you’ve also done. Below is what your QuickBooks Progress Invoice would look like.

I like to use the memo field to hold a notes – on this Progress Invoice I would add the following memo: “Specialty items delivered to job site – billed as stored materials.”

On the AIA Pay App, the $21,730.00 should appear in Column F – Materials Presently Stored (Not in D or E) on the Continuation Sheet, see below:

When it comes to entering your Vendor Bills and duplicate charges. It would depend on how the Items in your QuickBooks Items List have been set up. If each item has been set up correctly there shouldn’t be any issues. (That is an entire blog post all by itself!).

In my opinion, tracking stored materials is not appropriate in this situation. The Materials that are ordered, delivered to the job site, and are billed as stored materials are materials that are your company has ordered for this specific job.

I hope you find this article to be helpful, if so please take a moment to either leave a comment or share it on your favorite social media platform.