Retention or retainage is usually a specific percentage, for example 10%, of the total contract that is held back by the project owner in reserve to protect the owners interest. Retention is not held in a lump sum, but rather held at the stated percentage for the amount requested on each application for payment. Your contract should set the terms, including the percentage and when the hold-back will be paid.

Because QuickBooks doesn’t have a built-in retention function, like many of the more expensive construction specific software program, QuickBooks users must initiate work-arounds and make QuickBooks track retainage that is held on each progress invoice.

Over the years, I’ve seen several work arounds that various contractors, their bookkeepers, and even their accountants have implemented, such as:

- Simply leaving the retention amount of each invoice sitting in their open A/R.

- Billing for just the amounts on each line item that they will be paid for.

- Creating a Customer called Retentions Receivable and then making some fancy Journal Entries each billing period to move the retainage from the originating customer to the Retentions Receivable customer.

- Using a QuickBooks Discount Item to deduct retainage on individual invoices and mapping it to the Chart of Accounts as either an Income Account or Expense Account.

- Creating an Other Current Asset Account, called Retainage (Retention) Receivable and through the use of “Items” automatically move the money to this account on each invoice that is generated.

- Creating a Sub-Account of Accounts Receivable called Retainage (Retention) Receivable and then through the use of Items and additional invoices move the retainage amounts into this newly created Accounts Receivable sub-account.

Each of these methods has their own drawbacks, however, the first three (4) methods described cause the most problems with the contractors accounting records and are methods that I highly recommend that you avoid.

The easiest method that I know of, is tracking Retainage as an Other Current Asset Account on your Chart of Accounts – Balance Sheet section; however, MUST get with your accountant and have him teach you to do a journal entry that will remove the amount from Income.

To implement this system:

- Add an Other Current Asset account to your Chart of Accounts called Retainage or Retention Receivable.

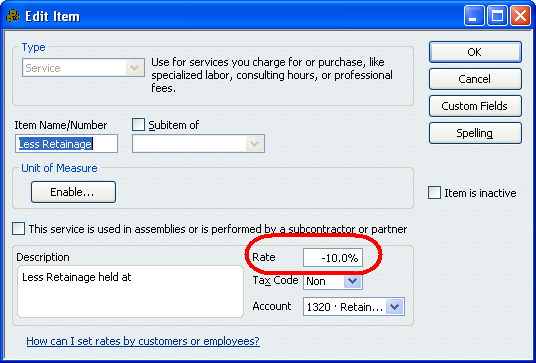

- Create an Other Charge OR Service item in your Item List called “Less Retainage”, map this to the account you created in Step 1, and in the Rate box enter -10.0%.

- Create another Other Charge or Service item in your Item List called “Retainage Due”, again mapping it to the account you created in Step 1.

- Make sure that you have a Subtotal item in your Item List.

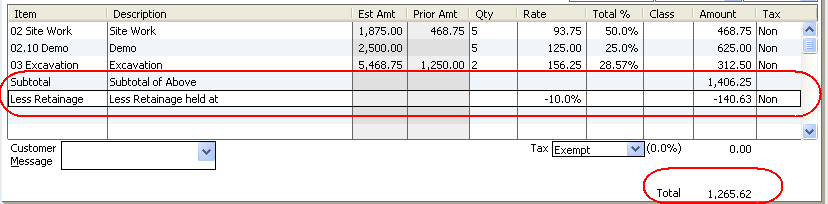

- Create your Invoice or Progress Invoice billing for the full amount before any retainage is withheld. On the first blank line at the bottom of the Invoice, select your Subtotal item and then your Less Retainage item – the balance on the invoice that goes to A/R is now the amount after retainage, and the retainage dollars are moved to the Other Current Asset Account.

- You can generate Reports on the Retainage Receivable account showing who owes you what by going to your Chart of Accounts, click on the account created in Step 1 to highlight it, click the Report button at the bottom of the window and choosing QuickReport .

- When you are ready to bill for retainage, create a “normal or regular” invoice using the Retainage Due item and entering the appropriate dollar amount from the report.

As I stated earlier in this article, this is the easiest method – because it’s just adding two additional items to the bottom of your invoice and all the math and work is done for you; however, the amount of retainage that you deducted shows up in your Profit & Loss Report in your Income Account (even if you run the reports on a Cash Basis) which does require that a Journal Entry be created to remove this from your Income. You should consult your accountant for the proper entry.

Sandra, you should probably discuss this with your CPA/tax preparer.

I have an retainage interest payable on my books, which does not get paid out to customer. Do I take the interest back to my Interest Earned account?

No easy or straightforward way that I am aware of.

You MIGHT be able to create a different item type for the GST (pointing it off the the proper account) and not use the “normal” GST item, then you could have your standard line items, the new GST item, then your 10% hold back on the total.

Try that in a copy of the data file and see what happens with any GST reports that you can run.

I’m assuming that each invoice has an open or unpaid amount that is equal to the retainage owed showing in A/r – if that’s the case, you can use the method described in this post and edit each of the invoices and enter the Subtotal and Less Retainage lines. HOWEVER, if these amounts are from prior years and you tax preparere/accountant has already filed your tax returns, consult with him/her on the best way to handle this. DO NOT make changes that will affect a prior years tax return without talking to him/her first.

How to post this amount from past invoices? The money has not been collected from the customer but the invoices less that amount have been paid. We are just starting QuickBooks and setting up the accounts and balances. What is the offset account to Retainage Receivable. Do I enter each of the invoices with just that amount as owed?

Hi Nancy, my problem is our customer wants us to follow the GST memorandum 19.1 sect 81-84. Example #1 Contract Price $100,000. plus GST subtotal les 10% Holdback. QB want to put the holdback first then GST, is there a way to correct this for this customer?