One of the biggest causes of confusion for contractors working on government funded construction projects is “how to calculate and display fringe benefits” on a certified payroll report.

Background:

Contractors who work on government funded construction projects are required to pay their employees a “prevailing” rate of pay; based on where the project is located and the type of work they are performing. This “prevailing rate of pay includes both an hourly wage rate AND an hourly fringe benefit rate. These rates are found on the Prevailing Wage Determination that is included in the contact package and you MUST pay your employees these rates of pay.

A wage decision might look like the screenshot below; just a listing of Work/Trade Classifications, along with hourly wage Rates and Fringes:

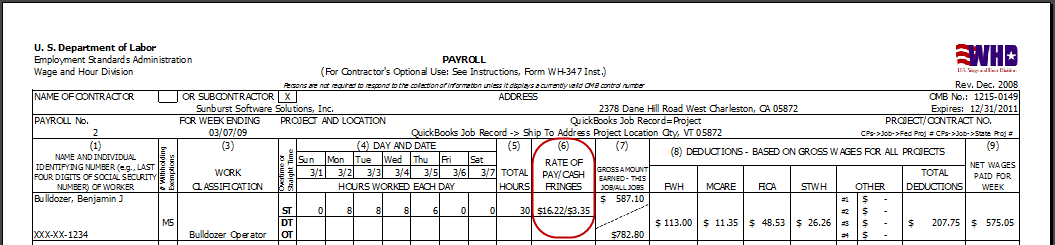

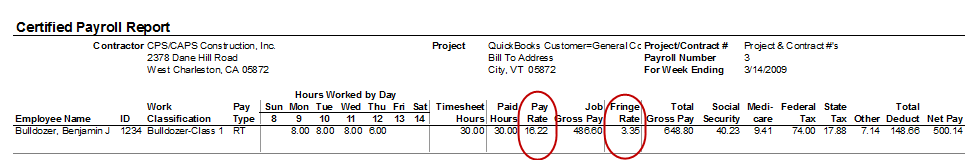

For the remainder of this article we will be working with various examples based on the Bulldozer Operator classification which has a base rate of pay of $16.22 and a fringe rate of $3.35 and how this information is to be reported. We will focus on the Federal or U.S. Department of Labor form WH-347 and we will compare the actual WH-347’s requirements to the alternate/substitute WH-347 produced by QuickBooks.

*The rules according to the U.S. Department of Labor regarding the calculation and reporting of Prevailing Wage Fringe Benefits on the WH-347

Column 6 – Rate of Pay (Including Fringe Benefits): In the “straight time” box for each worker, list the actual hourly rate paid for straight time worked, plus cash paid in lieu of fringe benefits paid. When recording the straight time hourly rate, any cash paid in lieu of fringe benefits may be shown separately from the basic rate. For example, “$16.22/$3.35” would reflect a $16.22 base hourly rate plus $3.35 for fringe benefits. When overtime is worked, show the overtime hourly rate paid plus any cash in lieu of fringe benefits paid in the “overtime” box for each worker; “$24.33/$3.35”. In addition, check paragraph 4(b) of the statement on page 2 the payroll form to indicate the payment of fringe benefits in cash directly to the workers.

Item 4 FRINGE BENEFITS – Contractors who pay all required fringe benefits: If paying all fringe benefits to approved plans, funds, or programs in amounts not less than were determined in the applicable wage decision, show the basic cash hourly rate ($16.22) and overtime rate ($24.33) paid to each worker on the face of the payroll. Check paragraph 4(a) of the statement on page 2 of the WH-347 payroll form to indicate the payment.

How rates of pay and fringe benefits are to be displayed on the certified payroll report when fringes are paid in cash.

This example shows the correct method of reporting the base hourly rate ($16.22) PLUS the hourly fringe rate ($3.35) being paid in cash to the employee ($16.22/$3.35). {Note: the employees rate of pay in QuickBooks is $19.57). Pay particular attention to Column 6 – Rate of Pay/Cash Fringes.

Now let’s look at the same certified payroll report as it is generated by QuickBooks. Pay close attention to the Pay Rate and Fringe Rate Columns – the Pay Rate comes through as the full $19.57 and in order to show the Fringe Rate of $3.35 you would need to manually adjust both the rate of pay and the fringe rate.

How rates of pay and fringe benefits are to be displayed on the certified payroll report when fringes are paid to approved plan, funds or programs.

This example shows the correct method of reporting only the base hourly rate ($16.22). Pay particular attention to Column 6 – Rate of Pay/Cash Fringes, as you should ONLY be reporting/showing the $16.22 rate of pay.

Now, let’s look at this same report generated by QuickBooks, keeping in mind that you could choose any of 3 options when creating this report.

OPTION 1 – QuickBooks recognizes company contribution items that you have set up for the fringes (Health & Welfare, Pension, and Vacation Fund) do NOT select/click on any of the items in the Fringe Benefits Paid box.

The Rate of Pay ($16.22) is displayed correctly, but the Fringe Rate column contains $0.00. This is “ok”, however, it is very misleading, because it could be taken to mean that you are not paying any fringes. Remember the rules state that you are to report the hourly fringe benefit rate that you pay in cash on the report.

OPTION 2 – QuickBooks recognizes company contribution items that you have set up for the fringes (Health & Welfare, Pension, and Vacation Fund) you click on each of these 3 items to indicate that these are your fringe benefit items.

The Rate of Pay ($16.22) is displayed correctly, but the Fringe Rate column contains $3.35. This is “ok”, however, it is very misleading, because it could be taken to mean that you are paying the fringes in cash to the employee. Remember the rules state that you are to report the hourly fringe benefit rate that you pay in cash on the report and that if you pay the fringes to approved plans you report just the hourly rate of pay.

OPTION 3 – QuickBooks recognizes company contribution items that you have set up for the fringes (Health & Welfare, Pension, and Vacation Fund) you click on each of these 3 items to indicate that these are your fringe benefit items and you choose to Apply these Fringe Benefit items to this project only (do not pro-rate by job).

The Rate of Pay ($16.22) is displayed correctly, but the Fringe Rate column contains $4.47 – which is incorrect. This is very misleading, because it could be taken to mean that you are paying the fringes in cash to the employee AND paying a higher fringe rate than required. Remember the rules state that you are to report the hourly fringe benefit rate that you pay in cash on the report and that if you pay the fringes to approved plans you report just the hourly rate of pay.

The bottom line of my finding when reviewing the way the QuickBooks calculates and displays the fringe benefit portion of prevailing wage on the “built-in” certified payroll report – is that you REALLY have to understand the reporting requirements before you submit your reports and that you should review the reports VERY carefully before submitting them.

Authors Note:

The certified payroll screenshots, with the WHD logo in the upper right corner, have been generated with Certified Payroll Solution, a QuickBooks integrated application specifically designed to help contractors comply with prevailing wage requirements. For more information, click here.

*(Source: United States Department of Labor, Wage and Hour Division (WHD), Instructions for Completing Payroll Form, WH-347 – https://www.dol.gov/whd/forms/wh347instr.htm)

[…] Yes, but the credit must be annualized (see question #7). Under the Davis-Bacon Act and 29 C.F.R. § 5.23 other company paid items such as Life insurance, Pension, Vacation, Holidays, Sick Leave and Supplemental Unemployment Benefits may also be used as a credit. Check State specific prevailing wage laws to make sure these items are also allowed – just because at the Federal level something is allowable does not mean it is also allowable at the State level. For more information, see Calculating & Displaying Fringe Benefits on a Certified Payroll Report. […]

Ilana

“If” it were me, I would show both the overpayment and underpayment at the base rate level and not do anything to change the fringe rate on the final reports.

What if the employee is over paid ? instead of 19.57 he gets paid 19.60 , how can we report the rate ? do we show the overpayment in the Cash in Lieu of Fringe 16.22/3.38 or in the base rate 16.25/3.35 ? and if we do the same whhen is underpaid? I need to know this information.

[…] you would report $30.00 in the Rate of Pay box, however, on the Federal WH-347 you would report the rate of pay in Column 6 as $20.00/$10.00 for Straight/Regular time and $30.00/$10.00 for […]

[…] This post was mentioned on Twitter by Quickbooks News. Quickbooks News said: Calculating & Displaying Fringe Benefits on a Certified Payroll …: In recent months, I have repeatedly seen post… https://bit.ly/cyJLHy […]