Taking a Health Insurance credit against the full prevailing wage fringe benefit and reporting it correctly on the Federal WH-347 Certified Payroll Report can be very confusing. This question was asked by a reader who recently requested our 4 Ways Contractors Pay Prevailing Wage Fringe Benefits eBook.

This is an issue that has been extensively belabored in our office (by me).

We offer all of our employees health insurance – the company paying 75% of the monthly premium and the employees paying the remaining 25% through employee deductions.

It gets so confusing and reading all the blogs etc. does not clarify it for me. I must be slow 🙁

How can I be sure that I am correctly accounting for this?

Constantly confused…. Thank you

————————————————————————————————————–

Taking a Health Insurance credit against the full prevailing wage fringe benefit IS confusing, it’s NOT just you.

From what “I” know (and realize that I’m in Vermont and know enough about prevailing wage rules & regulations to be dangerous – I may not know all the fine print for your specific state). I will explain what I know and you should then verify it with the Prevailing Wage Unit of your local Department of Labor just to make sure.

First you are going to need to determine what the monthly company contribution is for each employee, and for the sake of the rest of this example; let’s assume that we have an employee named Frank and your company pays $173.33 a month toward his health insurance.

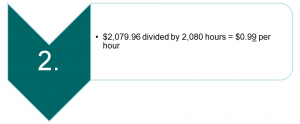

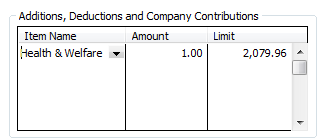

Step 1 – Take the $173.33 -> multiply it by 12 = this equals the annual maximum company contribution ($2,079.96).

Step 2 – Take the annual company contribution ($2,079.96) and divide it by 2080 hours -> this will give you an “hourly credit” of $0.99 – remember as far as prevailing wage fringes go everything is based on an hourly rate.

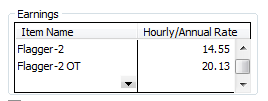

In QuickBooks edit Frank’s employee record -> going to the Payroll and Compensation tab -> in the Additions, Deductions and Company Contributions block, find the health insurance contribution item and enter BOTH the hourly “rate” and the annual maximum.

So now let’s say that Frank is classed as a Flagger making $11.15 per hour and the full fringe package is $4.40 per hour and based on your calculations above he has a $1.00 per hour company paid health insurance contribution. In QuickBooks his rate of pay becomes $14.55 ($11.15 base PLUS $3.40 cash fringe).?

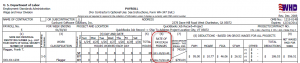

When you generate your Federal WH-347 certified payroll report you will want to pay special attention to Column 6 – Rate of Pay/Cash Fringes. Here you will want to report $11.15 (base rate)/$3.40 (balance of fringe benefit rate paid in cash).

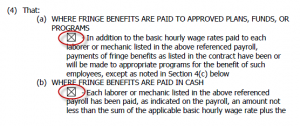

On the Statement of Compliance you will want to check BOTH boxes 4a – Fringe Benefits paid to approved plans, funds or programs AND 4b – Fringe Benefits are paid in cash.

Important Notes:

- 2,080 hours is a construction industry standard number of work hours per year. It is based on 40 hours per week in a 52 workweek period.

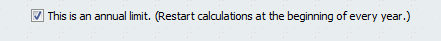

- You’ll want to edit BOTH the company contribution and employee deduction payroll items and indicate that each has an annual limit in order for QuickBooks to automatically stop withholding when the annual limits have been reached.

- On a weekly basis, both the company contribution and employee deduction should be calculated based on the TOTAL number of hours the employee worked on BOTH private and prevailing wage jobs.

- When the company’s annual contribution limit has been reached you will want to “add” the credit back to the employee’s hourly rate of pay for the balance of the year.

- You’ll need to perform these calculations each time health insurance premiums change.

______________________________________________

Screenshots of the WH-347 Certified Payroll Report and Statement of Compliance were taken from actual reports that were generated using Certified Payroll Solution and QuickBooks data. Learn more about Certified Payroll Solution by clicking here.

Learn more tips like this by signing up for our 2 hour “How to Fulfill Your Certified Payroll Reporting Requirements” webinar.

Hi Suzanne – I just popped you off an email – might want to check your spam or junk mail folder. I’m glad that you find the blog to be helpful 🙂

Hi,

I love your tips and articles, thank you! The world of prevailing wages is a really complex one. Glad I found this site to sort through the calcs.

I do have a question for Nancy Smyth though, if she would be kind enough. This is regarding 401k contributions and matchings calcs.

How can i reach her? Would she be available to email me or talk to me?

Thanks again,

Suzanne