When an employee uses his/her own money to pay for a business related expense it is money that they have loaned the company, and the company should account for those expenditures in the same manner in which they would if the company had made the expenditures themselves – in other words – those reimbursements should be correctly assigned to the appropriate expense or cost of goods sold accounts in QuickBooks.

As a bookkeeper handling reimbursement requests, not only do you need to make sure that the expenses are correctly recorded; you also need to make sure that the manner in which expense reimbursement requests from employees meet accountability standards by the IRS.

Every company should adopt an Accountable Plan for reimbursements. An accountable plan makes reimbursements non-taxable and is not reported on W-2, as long as the plan meets the following 3 IRS requirements:

- There must be a business purpose, meaning that the expense would be deductible if the company actually made the initial outlay of cash.

- The amount, time, use, and business purpose of the money spent must be substantiated within a “reasonable” amount of time; meaning that the employee should submit a written expense account detailing the money spent, the purpose of the expenditure, what job or customer the expenditure related to, and receipts that prove the expenditures.

- The employee must return the unsubstantiated amount within a reasonable period of time; meaning if the employee was given $1,000.00 but only provided documented receipts for $900.00, the remaining $100.00 would need to be returned to the company.

If these conditions are not, especially condition number 3 when an employee did not return the $100.00, you would then take that $100.00 and only then add it to payroll and withhold applicable taxes.

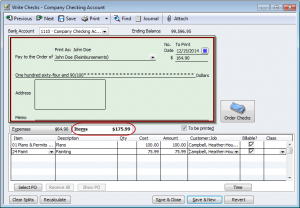

Recording the reimbursements in QuickBooks can be accomplished by using either the Write Checks window or the Enter Bills window, however, it is important to note that that John Doe the employee should also have a John Doe (Reimbursements) record in the Vendor List; using the John Doe record in the Employee List when issuing payroll and John Doe (Reimbursements) from the Vendor List when entering expenses for reimbursements.

Recording Reimbursements for Indirect Expenses, such as Telephone, Gas, Mileage, Purchase of Small Tools, Postage, etc.

When an expense report is submitted that includes any of the Indirect Expense items shown above, when you write the check or enter the bill, you will want to use the Expense Tab to record the amounts, if you will be including any of these costs on a customer invoice, click (check) the Billable option) and when you create the invoice, click on Time & Expenses to pull these costs onto the invoice. If these costs will not be billed to the customer, do not check the Billable column.

Recording Expenses for Job Materials or other Direct Job Related Costs

When an expense report is submitted that includes any of the Direct Expense items shown above, when you write the check or enter the bill, you will want to use the Items Tab to record the amounts, if you will be including any of these costs on a customer invoice, click (check) the Billable option) and when you create the invoice, click on Time & Expenses to pull these costs onto the invoice. If these costs will not be billed to the customer, do not check the Billable column.

This article provides you with basic guidelines for handling some types of reimbursements, however, it does not touch on handling reimbursements for travel, lodging, or meal reimbursements as they have far more stringent rules. Consult a local accounting professional for additional help.

Suzanne

Did you ever get this resolved? It sounds odd indeed. I’d check the health of your QB file and perhaps do some maintenance, check out this blog post.

Hello! What a great column. Today, I was going to enter receipts submitted by my boss (company owner) that will later be reimbursed to her when there is enough money to do so. However, here is what happened: I opened her name in the Vendor center and clicked on enter bill. I typed in her name, the date and the amount and assumed when I tabbed it would drop down to the lower portion of the form where I would enter the expense account to charge the receipt to. However, instead of a blank form, there was a long list of previously entered expense items and I could not tab into the expense column. What the heck is going on????

Hi Lisa – I’m so glad that you found this post helpful!

This gave me EXACTLY what I was looking for…THANKS!!!

[…] Having too many business expenses […]

Hi Jeannie

Without actually “seeing” what’s going on in QuickBooks – I’m going to be VERY cautious in my answer.

Make a backup of your QuickBooks file.

Go into the Reimbursement check – actually Edit it so you can see the accounts that it lists with the dollar amounts. Pick one item.

Go and look at the bill that was entered for this item – is it posted to the same account?

If so, void the check – Edit menu -> Void – in the Memo line enter Paid by Owner X on check # whatever.

Rerun your report and see if the amount changed.

If so, void the other bills using the same message in the memo line.

Hi Nancy,

Our small business just purchased Quickbooks in September. Before this, we had been doing everything manually. I have entered every invoice and receipt for the year of 2011. I LOVE quickbooks, but I am running into a slight problem. Another owner/ employee pays some of the bills every month, such as the phone bill, the credit card bills, the van payment, insurance, etc and the company reimburses him on one check every month. I entered these bills individually on Item Receipts under each vendors name, and the check that is written to him for reimbursement is listed as an Expense Reimbursement on the check register. Now I printed the Profit and Loss statement, and it shows these bills as an expense PLUS the expense reimbursement for these bills as another expense. So, if the bills are $1,500 total, with the Expense Reimbursement for these bills, it shows expenses of $3,000. How do I fix this? Do I delete one or the other?

Hi Deb

I “think” it depends on what you use for your direct deposit. I would say give it a shot with one employee and see how it goes. 🙂

Hi Nancy,

If I have my employees also set up as Vendors for reimbursements, do you see any problem with also using Direct Deposit to pay them?

Thanks!