Tracking employee advances or loans in QuickBooks on future paychecks is a must for those companies that has a policy that allows giving employees advances/loans for personal reasons.

- Including it with the employees regular paycheck

- Writing a regular check

- Giving the employee cash from the company Petty Cash account

Step 1 – Create an Other Current Asset Account to track employee advances/loans

The first thing that you need to do – or have in place – is an Other Current Asset type account in your QuickBooks Chart of Accounts to track the money that is given to the employee.

If you need to create the account:

- From the Lists menu -> choose Chart of Accounts

- Click the Account button at the lower left -> choose New

- Click the radio button next to Other Account Types -> and from the drop down menu choose Other Current Asset -> click the Continue button

- Complete the details for the account -> Account Name = Employee Advances/Loans -> Account Description = To record employee advances or loans and repayments on future earnings.

Important Note: If your company frequently provides employees with advances on future earnings, create sub-accounts for each employee advance or loan; including the employee name and loan date in the account name.

Issuing an Advance or Loan to the employee as part of his or her regular paycheck.

If you want to provide the advance or loan money with the employee’s regular paycheck you will need to have in place or create an “Addition” type payroll item to record the money given to the employee.

If you currently don’t have an item in place, you will need to create one.

- From the Lists menu -> choose Payroll Item List

- Click the Payroll Item button at the lower left -> and choose New

- Choose Custom Setup -> and click Next

- Click the radio button next to Addition -> click the Next button

- In the Name field, enter the date, the employee’s name, and indicate if it is a loan or an advance. For example: 5/9/11 Mark Mason Advance. Click the Next button.

- On the Expense Account window, using the drop-down menu, choose the appropriate “Advance” account -> click the Next button

- On the Tax Tracking Type window, select None and click the Next button.

- On the Taxes window, there should be no check marks -> click the Next button

- On the Calculate based on quantity window, select Neither -> click the Next button

- On the Gross vs. Net window, select net pay -> click the Next button

- On the Default rate and Limit window, you can either leave both fields blank OR you can enter the full amount of the advance or loan in the first box -> click finish.

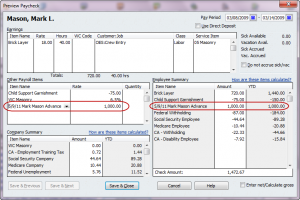

When you create the employee’s regular paycheck, from the Other Payroll Item box, select the “Addition” payroll item and enter the dollar amount.

Providing an advance or loan by writing a check.

Create an entry for the employee in the Vendor Center or the Other Names List, use this newly created name when completing the QuickBooks Write Checks window and from the Expenses tab, select the appropriate Employee Advance/Loan account from your Chart of Accounts.

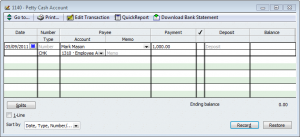

Giving the employee cash from the company Petty Cash Account.

You’ll want to make sure that the employee’s name exists in either your Vendor Center or in the Other Names List.

Open your Petty Cash Account register, select the Vendor or Other Name entry, enter the dollar amount given to the employee and select the appropriate “Advance/Loan” listing in your Chart of Accounts.

Repayment of employee advances can then be paid back to the company through payroll deductions, which is the subject of tomorrow’s Wednesday’s blog post.

This way it keeps everything that is not payroll related out of payroll. It also provides you with a means of tracking how the petty cash is spent.

Thanks for the info! I’m wondering why when I issue a petty cash advance I’m not using the employee name. Why do I have to set up a vendor or other?

Hi

Without knowing how you have everything in QuickBooks set up, it’s difficult to provide you with a solution other than to discuss this situation with your accountant. Normally, you would go into the Other Current Asset account that held the loan receivable from your employee and enter an opening balance.

Hello

Nice post.

How can I enter beginning balance of loans. I just moved to QB and one of the employee has loan. How can I enter the loan amount so it is tracked in future paychecks.

Thx

OOzy

Tammy

I understand what you want to accomplish – but would need to see how things were set up and I’m betting that your setup needs some tweaking to accomplish what you need it to. Why don’t you give me a call on Monday (888-348-2877) and we’ll schedule some time to take a look.

We are giving employees advances and then taking them as a deduction off of their pay checks. In the payroll item list we set them up but when it gets deducted off of their check it is not zeroing out in the chart of accounts. We are wanting them to cross theirselves out that shows them having a zero balance once they have paid us back. Or show they have a running balance with an active loan they have been given. Can you help us? I am not sure that it is set up right and been working on this for awhile. Thanks- Tammy

Hi

I’ve had to do this a couple of times in the past – I created a special payroll wage item called Unpaid Loan (now wages). I then created an actual paycheck using that new payroll wage item – that makes the unpaid balance part of the employee’s wages, takes care of payroll tax liabilities and would be added to gross wages on the W-2. Your CPA should have provided you with specific instructions for the way that he/she wanted this handled.

Hope this helps.

HI!! I have a problem that seems to have no answer. 🙁 We have written off several loans that were giving to an very long time employee and now the owner wants to write it off. Our CPA says that we need to pay the liabilities for it and make that loan as part of his current earnings. The check was issue not as payroll item, but as a loan, that was being deducted thru his payroll. So now I have spent most of my day trying to figure that one out.

We have figured out the taxes but, not how to record this loan as part of his annual income.

Hope you can help!

Have a blessed day!

p.s. I am glad I had copied the whole text, after I hit post comment it gave me an error saying wrong “CAPTCHA code” and wiped everything off! lol

[…] could set up an Employee Loan account – this would be an Other Current Asset account on your Chart of Accounts, and then create a […]

Hope you get things straightened out Shari – if not post here with info on where you are having problems and I’ll try to help.

Looks like I went in the wrong order. I already set up and paid out the advance. now I’m having issues entering it to be paid back. Thanks for your help

Andrea

I would recommend that you turn on Manual Payroll in QuickBooks. To turn on Manual Payroll:

from the QuickBooks Help menu -> choose QuickBooks Help

on the Have a Question window, type in Manual Payroll and press Enter.

Look for the topic called “Calculate payroll taxes manually (without a subscription to QuickBooks Payroll)” and click on it.

In the Help Topic, look for the 3rd bold heading “Set your company file to use the manual payroll calculations setting” and click the link that says “manual payroll calculations” -> this opens a new help topic and at the bottom of the window you’ll see a bold heading “If you are sure you want to manually calculate your payroll taxes in QuickBooks” and then a link to “Set my company file to use manual calculations”.

Yes, Intuit makes it very difficult to find the instructions for turning on manual payroll, after all, they do want you to subscribe to one of their payroll services.

Once manual payroll is turned on, then you can duplicate the payroll information from your service and keep track of those deductions (as well as gross wages and taxes). I will warn you that this is a LOT of work.

And I do apologize, the way I read your original post I “thought” you already had manual payroll turned on.

What do you mean set it up the same way? If I do not do payroll in quickbooks I don’t have the option of payroll in Quickbooks so I can’t just set it up and have a match of it in the bank transactions. I want to keep records of the deductions of health insurance, 401k, draw repayments, child support, etc…

Even if you are outsourcing payroll and entering all of the detail in QuickBooks, I would set it up the same way.

What if you out-source your payroll and an employee had payed the loan/advance back through deductions in payroll but you are imputing the information into quick books. Where would you put the repayment of the loan/advance then?

[…] a payroll advance explaining to your employees that this advance will be paid back as an employee payroll deduction […]

Tom, I’d really need to see the setup of the item. Maybe you can edit the item and look at the setup to see where it’s “off” – but make a backup of your data file before changing anything. Is the loan repayment from a single check or will it be spread out over multiple paychecks? If you’d like, we could set up a fee-based remote session and I could help you out. If you think you would be interested in that, you can purchase an hour of “training” from the order page on our main website – in Step # 3 – https://www.sunburstsoftwaresolutions.com/order-information.php Just make a note in the Special Instruction field as to what it’s for.

I set up an account for an employee loan as a separate check (not part of his payroll check, with repayment as a payroll deduction). Apparently, I also selected that this repayment amount would be deducted from “gross pay”. I’m doing my own payroll, so the actual calculation is being done on net pay, but on his paycheck, it is reflected as “deductions from gross”. Is there a way to change that, now that it is set up?

Thank you for your help!

Tom

[…] this week, in our post QuickBooks Payroll Tip – Tracking Employee Advances or Loans, we discussed three different ways in which to record an advance or loan that was given to an […]