The benefits of paying the Prevailing Wage Fringe Benefit portion to bona-fide plan is often misunderstood by employers and employees alike.

Union contractors automatically pay the total hourly fringe benefit rate to the union hall on behalf of the employee, usually splitting the full hourly rate into specific “funds” – Health & Welfare, Pension, Vacation, etc. When this happens the Union contractor doesn’t pay payroll taxes, worker’s compensation, or general liability insurance on this amount.

Non-Union contractors, on the other hand, can pay the fringe benefit rate to the employee in addition to the stated base rate of pay OR they can pay it into a bona-fide plan on behalf of the employee.

We’ll look at the differences and discuss the benefits to both employees and employers.

In the following examples we’ll be working with a base rate of $41.51, fringe rate of $18.72, a Worker’s Comp experience rate of $10.70 per hundred dollars in wages, and a General Liability Insurance Experience rate of $0.636 per hundred dollars in wages and a standard 40 hour work week.

When the fringes are paid in cash – included in the employees base rate of pay

As an employee you are paid $60.23 per hour ($41.51 + 18.72) x 40 hours = $2,409.20 gross with a net of $1,512.38. As an employee you are paying $896.82 in taxes – see sample paycheck below:

As an employer you pay $560.99 in payroll taxes, worker’s comp and general liability insurance in addition to the $2,409.20 gross wages for a total of $2,970.19 to have the employee on the jobsite for 40 hours.

When the fringes are paid to a bona-fide plan on behalf of the employee

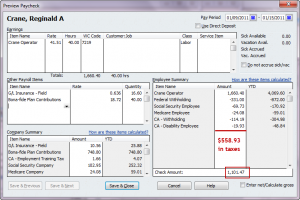

As an employee you are paid $41.51 per hour x 40 hours = $1,660.40 gross with a net of $1,101.47 PLUS $748.80 is contributed to the bona-fide plan on your behalf for a total of $1,850.27. As an employee you are paying $558.93 in taxes {in reality that is a savings of $337.89 in taxes) – see sample paycheck below:

As an employer you pay $1,135.96 in bona-fide plan contributions, payroll taxes, worker’s comp and general liability insurance in addition to the $1660.40 in gross wages for a total of $2,795.86 to have the employee on the jobsite for 40 hours – that’s a savings of $174.33.

Many employers and employees are rightfully cautious about the cost of setting up a bona-fide plan. Many times setting up a traditional 401(k) or 403(b) plan is costly (one customer recently told me that it would cost them $5,000.00 to initially set up the plan) and then the employees must wait until legal retirement age before being able to start withdrawing the money.

The Supplemental Unemployment Benefit Plan (SUB Plan) offered by Prevailing Wage Contractors Association (PWCA) has a start up cost to the employer of $200.00; and provides employees access to the money when they need it most – when they are not working or have missed some time. The SUB Plan can be used to pay an employee when he has a short work period; which is defined as working less than 40 hour in a week or less than 173 hours in a month. Short work periods can be caused by layoffs, bad weather, illness, lack of work, equipment down time or any number of reasons.

For additional information about the SUB Plan offered by PWCA, visit their website – or contact Nancy Smyth.

[…] Take a look at this article on my blog that shows the difference between paying the fringe to the employee vs. putting it into a bona-fide plan – https://blog.sunburstsoftwaresolutions.com/2011/05/25/the-benefits-of-paying-prevailing-wage-fringes-… […]