A QuickBooks for contractors tip about issuing joint checks to a subcontractor and a lower tier subcontractor or material supplier for payment for work completed on a construction project.

Unlike many high-end construction accounting packages, QuickBooks doesn’t have a way to handle this automatically — or easily.

This QuickBooks for contractors tip provides what we consider to be a best practice when a situation like this arises.

Problem:

Joe’s General Contracting, Inc. needs to issue a $10,000.00 joint check to Sam Subcontractor AND O’Fallon’s Gravel for sand, gravel, and crushed rock which was delivered to a jobsite. Sam Subcontractor is one of Joe’s regular subcontractors and is already in the QuickBooks Vendor List; O’Fallon’s Gravel is not a normal supplier and is not setup in the Vendor list. Sarah, Joe’s bookkeeper isn’t sure how she should handle a joint check.

Solution:

When Sarah is ready to write the joint or two-party check, she should follow these steps:

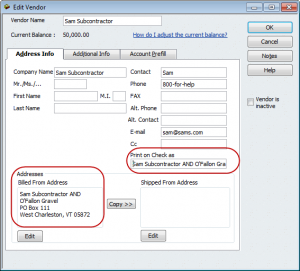

- Edit Sam Subcontractors Vendor record in QuickBooks and in the Print on Check as field, she should add AND O’Fallon Gravel. She should also edit the Billed From Address so that it to displays Sam Subcontractor AND O’Fallon Gravel. Clicking the OK button to save her changes.

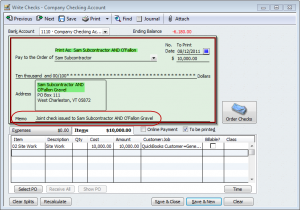

- From the Write Checks window, select Sam Subcontractor, enter the dollar amount. In the Memo field type in Joint Check issued to Sam Subcontractor AND O’Fallon Gravel and then job cost as usual.

- Print just this check.

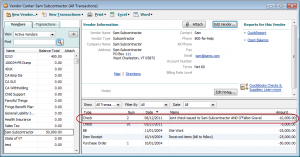

- Immediately go back to Sam Subcontractors Vendor record and delete all references to O’Fallon Gravel, click OK to save the changes.

- Customize the columns to display in the Vendor Center to include the memo field.

Make sure that you also have the proper Lien Waive and Release forms.

We hope you found this QuickBooks tip to be useful — if so please take a moment to leave a comment, share it on your favorite social media site or click the +1 button below.

Christopher, in many ways I agree with you and your suggestions. I developed this approach as an alternative for those people who have indicated that they do not want to use a “third vendor” approach because it adds too many additional entries in their Vendor Lists in QuickBooks, which they said caused too much confusion. Thanks for dropping by and taking time to leave a comment.

I don’t believe this above is a best practice – A better alternative is to set up a Joint Check Agreement Vendor for this and the “AND” vendor/supplier. It might be JCA – Sam’s AND O’Fallon. When you process invoices you get on this joint check arrangement, have the sub submit it seperate and inclusive of the labor, materials and other related to the joint check activity. The payee will be Sam AND O’Fallons and will be durable – i.e. no need to remember to alter the vendor master file – essentially this is the Third Vendor approach, presumably you would likely have a vendor for Sams, O’Fallons and the #3 the JCA-Sams-Ofallons. … and that’s how its done , son in QB and elsewhere.

Yes, thanks for the QuickBooks tip. Seems like it’ll be very helpful in those situations.