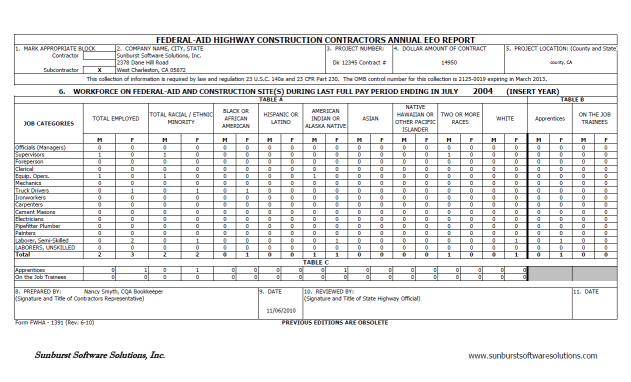

Technology is Changing How We Submit Certified Payroll Reports

Technology - computers, software, and the internet - has changed how we create and submit certified payroll reports over the last decade. For many years a paper certified payroll report - either the Federal WH-347 or a state specific form - was what you needed; and then you dug out the typewriter and typed the information onto the form - or - you painstakingly handwrote the information onto the form. Then along came computers and programs like LOTUS 1-2-3 and Excel and we would recreate the layout of the paper form using the program and fill it in each week – it was faster, neater, easier to correct typo's, and we felt that we were automating the task at hand. Then, some of the software companies created a “certified payroll…